Decoding the Q4 Earnings Season

Remember the pandemic months when companies benefited from operating leverage and reported solid margin expansion? That era has ended. Unfortunately, so has the era of companies benefiting from post-pandemic pent-up demand. This is not such a bad thing though. In the final quarter of 2022, companies focused on improving efficiency, which boosts their fundamentals in the longer run.

One word that slipped into almost every earnings call in the season was “inflation.” Some leading companies were able to raise prices to offset the impact of inflation on their bottom line. However, most companies, across sectors, were forced on trimming costs to defend their margins. Curtailing costs was the main driver of the fourth-quarter earnings beats, which bodes well for an improvement in corporate fundamentals ahead.

All was not well. While around 70% of S&P 500 companies reported earnings beats, the magnitude of the earnings upside, averaging 1.6%, was the lowest in 15 years. Also, the earnings beats were up against low expectations. Looking at profit growth of S&P 500 companies, there was a cumulative decline of almost 5% in the fourth quarter. This also marked the sixth consecutive quarter of margin contraction.

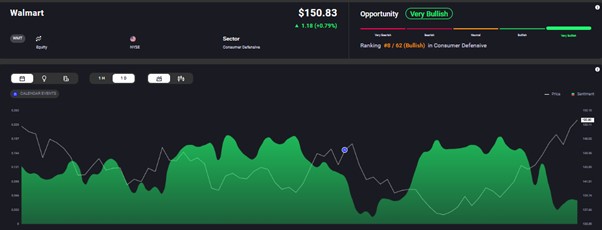

The double-digit price hikes announced by big brands did lead to positive revenue and earnings surprises. Walmart posted revenues of $164.0 billion and earnings of $1.71 per share, with both figures handsomely beating market expectations. Target’s revenue grew 1.3% to $31.4 billion. On the other hand, the price hikes led to a decline in sales volumes. Coca Cola raised prices by 12% in the fourth quarter and saw a 1% hit to volumes, while Procter & Gamble took prices up 10%, and its volumes contracted by 6%. Sentiment for Walmart and Procter & Gamble remains bullish, as can be seen on Acuity’s AssetIQ widget.