It’s been half a decade since the US had a meaningful Asian economic policy. The Trans-Pacific Partnership (TPP) was once poised to become the world’s largest Free Trade Agreement (FTA), covering more than 40% of the global economy. The US intended the TPP to create a stronger foothold in the Asia-Pacific region, markedly excluding China.

FTAs remain unpopular on both sides of the political aisle in the US, since they lead to the loss of blue-collar jobs in the country. The Biden administration, backed by a majority of US Labor Union households, does not have the political will to re-join the TPP. The administration was not even interested in pursuing the Trade Promotion Authority (TPA) renewal that allows the President the authority to enter trade and tariff agreements. Biden simply let the TPA expire in 2021.

The Power That is China

Since the signing of the TPP in 2016, China’s influence has only continued to grow in the region. For example, Chinese trade with the Association of Southeast Asian Nations (ASEAN) bloc totalled $685 billion, eclipsing American trade with the bloc, at $362 billion. The Asian dragon has further entrenched its position by applying to join the TPP and by entering the Regional Comprehensive Economic Partnership (RCEP), whose 15 Asia-Pacific members account for over 30% of global production. Brookings Institution estimates that the RCEP could add $200 billion to worldwide GDP and $500 billion to international trade by 2030.

The US now finds itself on the outside, looking at a region where policies are increasingly shaped by Chinese interests. With their new Indo-Pacific Economic Framework, the US attempts to fill the hole in its Asia strategy. How would this new policy affect the global financial markets?

The Indo-Pacific Economic Framework (IPEF) and Financial Markets

The Biden administration’s stance towards China has been much like its predecessors. It has broadly maintained Trump’s tariffs on $370 billion of Chinese imports. The administration also sees China as one of the major threats to the business principles it helped set up in Asia. China has been criticised in the past for its lax view on labour and environmental standards, intellectual property rights, and state-controlled businesses. By setting up the RCEP, these standards could permeate into economies like Indonesia and Vietnam, which are increasingly reliant on China for trade. The Indo-Pacific framework ostensibly seeks to combat China’s influence. The agreement seeks to promote US economic principles, especially in emergent sectors like digital trade and green technology.

The details of the IPEF are yet to be announced. They are possibly even further delayed to account for the foreign policy implications caused by the ongoing Russian invasion of Ukraine. What is clear currently is the stated focus of the policy, which is to create a secure and free Indo-Pacific region, deepening existing connections and building resilience to universal threats like climate change. The overall impact of the IPEF could be hugely positive for equity markets globally.

What This Could Mean for Equity Markets

US involvement continues to be necessary to Asian markets despite no current multilateral partnership. In the ASEAN bloc, it is the largest investing partner, investing more than the next three investment partners combined.

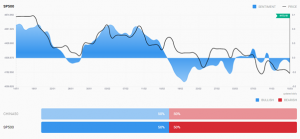

Asian stocks have historically had a positive correlation with US stock markets. This has a deeper relationship than driving sentiment. When US equity markets rally, the stocks become more expensive, which triggers a relocation of funds towards other countries. Equity markets also drive the US dollar. With an appreciation in the greenback, foreign equities become cheaper in US dollar terms and attract more investments from the US. The relationship between Asian and US equities could strengthen with the IPEF. There is also an emphasis on collaborations in the health, cyber and tech spaces. For Asian equity markets, this could potentially lead to rallies in these sectors.

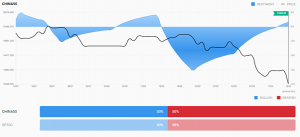

The correlation between US and Chinese stocks has increased over the past decade, with China’s emergence as a global economy. The correlation is also reflected in the market sentiment for these indices, as seen on Acuity’s Sentiment Widget.

The potential launch and success of the IPEF, which excludes China, could cause a realignment in markets and such correlations.

What This Could Mean for Other Markets

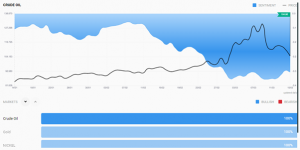

When looking towards Asia, the Biden administration currently prioritises shared investment in resilient supply chains and green technologies. The IPEF also proposes increased spending to close the Indo-Pacific region’s infrastructure gap, with a focus on improving global telecommunication. An increase in physical infrastructure could also feed into the ongoing commodity rally that analysts have already predicted might be a supercycle.

Without a trade agreement, the IPEF stands as an unattractive counterpart to the RCEP and China’s Belt and Road Initiative. The main attraction of Biden’s Asian strategy is the prospect of increased investment in a region that is one of the fastest growing in the world. This is likely to boost global financial markets.