Apart from tech giants, the telecom and healthcare sectors could be the hardest hit by higher taxes. If these companies waver due to the tax hike, it could be brutal for the stock market.

The bad news for companies (and their stocks) doesn’t end there. While businesses pay higher taxes, they will also bear the burden of an increase in minimum wages. Although historically a change in tax rates or wages have not materially impacted the stock market, Biden couldn’t have chosen a worse time for this twofold setback. America’s GDP has just contracted by more than 30% and businesses are in a vulnerable, uncertain state.

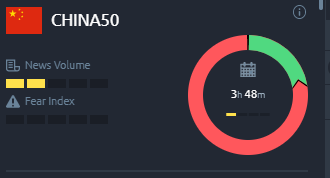

Asia, on the other hand, seems eager to see a Biden victory, given the current US-China tensions.

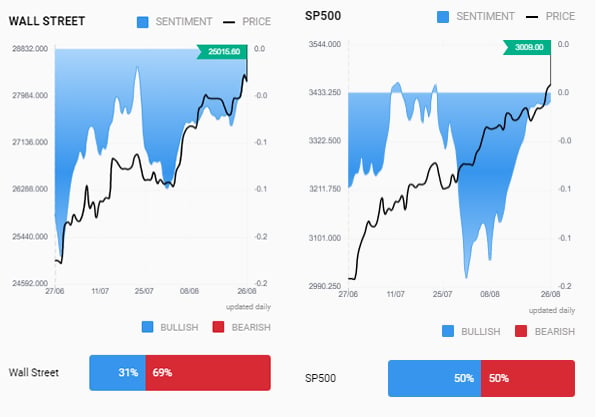

The onslaught from the Trump administration has hit investor sentiment in the Asian markets.

A Biden win could dampen risks in Asia’s largest economy and boost Australian markets as well. The risks will not be completely mitigated, and Asia’s technology and trade sectors may continue to face political headwinds. What gives some hope is that the issues may be handled in a less kneejerk and confrontational manner. Yes, we mean Biden may tackle issues more diplomatically.