The resurgence of the pandemic and Beijing’s zero-covid policy pulled the reins hard on the Chinese economy, which almost screeched to a halt. China’s economy grew by merely 3% in 2022, below most G20 countries. The news triggered massive stock selloffs by large investors, including Japan’s SoftBank Group and Warren Buffett’s Berkshire Hathaway, causing panic among retail traders.

With the turn of the new year, we saw the Asian dragon unfurl its wings. In the first quarter of 2023, the Chinese economy grew by 4.5%, handsomely surpassing expectations. Was this merely due to pent-up demand or can China still breath fire to fuel the global economy?

What’s Feeding the Dragon Now?

The supply chain constraints during the pandemic forced foreign companies to pull out of China and its exports took a massive hit. The country had no option but to look inwards. But there was a silver lining. Through the pandemic, resurgence and reopening, China held its position as the world’s second largest consumer. Although China faces an uncertain global economic environment, its domestic consumption appears strong enough to drive the country’s economic growth in 2023.

China’s consumer confidence improved to 94.90 in March, from 94.70 in February and 91.20 in the previous month. Retail sales made a strong rebound in March, growing by a healthy 10.6%, after the previous month’s tepid 3.50% growth. The trend continued in April, with China reporting 18.40% retail sales growth.

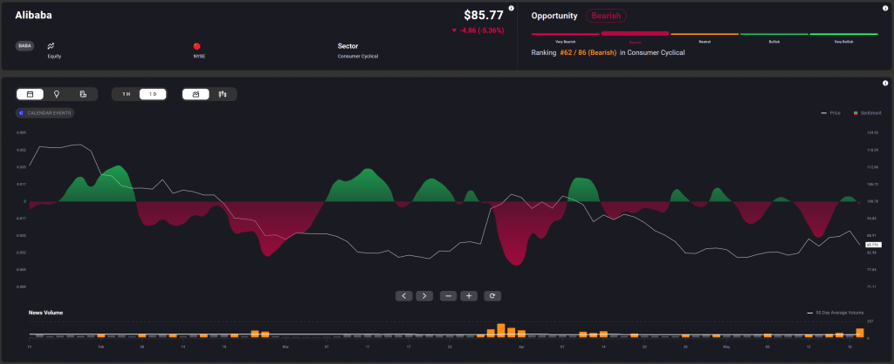

Strength in China’s consumer demand could propel the stocks of the top three ecommerce companies, Alibaba, JD.com and Pinduoduo. Alibaba has been in the spotlight this year. Speculations of the company moving out of China hit the stock hard in January. It soon rebounded on Alibaba’s plans to integrate Tongyi Qianwen, its ChatGPT-style robot, beginning with the workplace-messaging app DingTalk. The Chinese ecommerce giant’s stock spiked by a whopping 14% on March 28, after the company announced plans to split into six separate units, each with its independent IPO.

Alibaba swung to profits of 23.52 billion yuan in the latest quarter, versus a year-ago loss of 16.24 billion yuan. Despite this, its stock declined more than 5% as investors were disappointed with its revenue growth in the quarter. This could be only a temporary hiccup before the stock reverses and begins its upward trajectory this year.

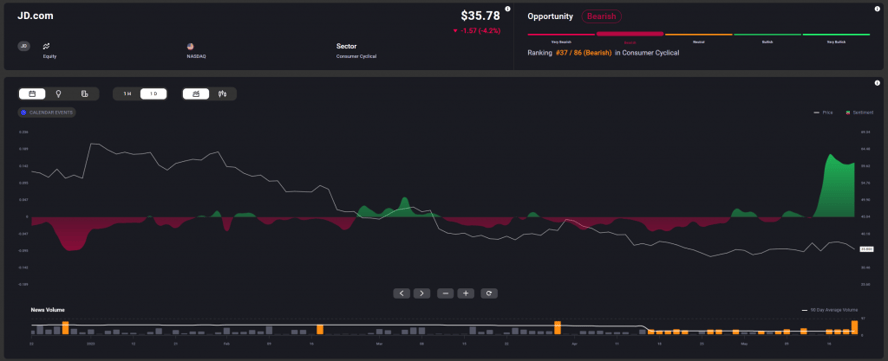

JD.com reported 1.4% revenue growth for the first quarter of 2023. While this was nothing to write home about, its bottom-line certainly was. JD.com posted a net profit of $912 million, versus a loss in the year-ago quarter. The retail giant ended the first quarter with around 590 million active customer accounts.

Pinduoduo’s stock also attracted a lot of short interest even after reporting 46% revenue growth and 42% earnings growth for the fourth quarter.

For JD.Com news sentiment has turned more bullish in recent days and price is yet to react. News volume has also increased sharply, which may be positive for price in the short term.