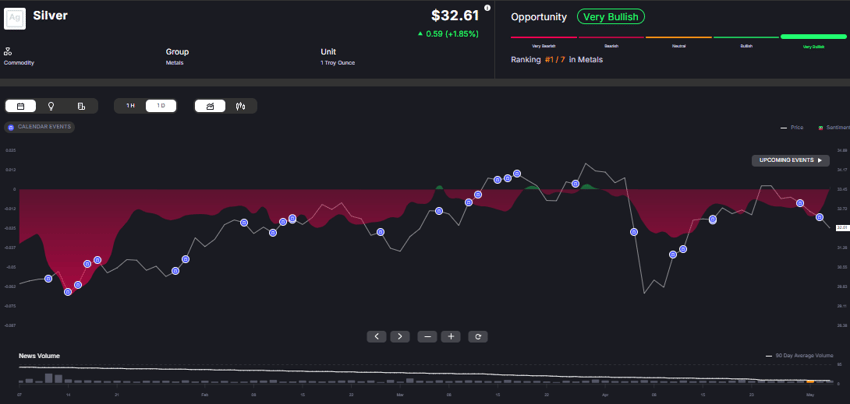

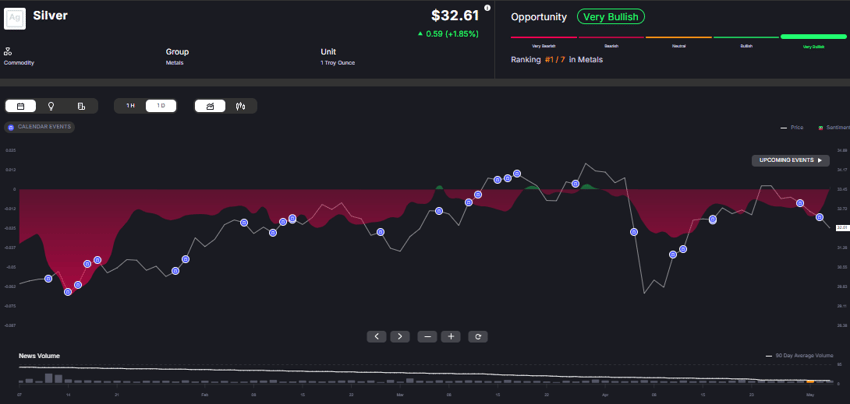

Silver prices jumped 18% in Q1 2025, and analysts say the rally is just beginning. Why it matters:

Silver’s rare dual role as a precious and industrial metal makes it uniquely positioned to benefit from both safe-haven demand and booming green tech industries like solar, electronics, and semiconductors.

By the numbers:

- 1.20 billion ounces of global silver demand expected in 2025

- 1.05 billion ounces of global supply forecast (+3% vs. 2024)

- Gold-silver ratio: 100:1, signaling silver is historically undervalued

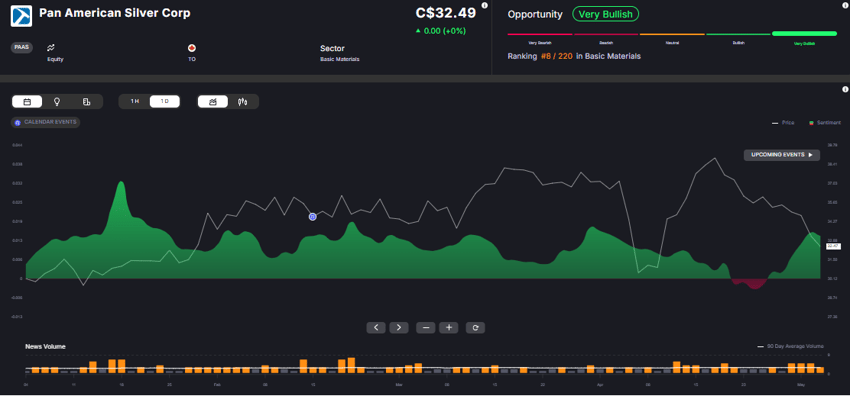

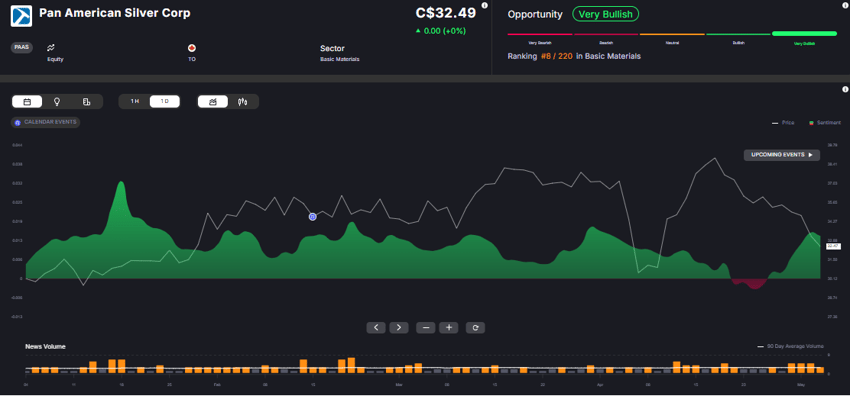

- +10.58% YTD rise in Pan American Silver stock

The big picture:

Silver has a track record of outperforming gold in bull markets. It surged past gold during the pandemic rally of 2020 and again in 2024 (+34% vs. gold’s +26%). Financial author Robert Kiyosaki expects silver’s price to double in 2025.Driving the news:

- Central banks cutting interest rates

- A weakening U.S. dollar

- Rising geopolitical tensions and trade disputes

- Strong green energy and electronics demand

What to watch:

- The gold-silver ratio. A reading over 80:1 often signals strong upside for silver.

- Ongoing sentiment shifts tracked by tools like Acuity’s AssetIQ, which currently shows a bullish outlook on silver.

The bottom line:

2025 could be the year silver outshines gold. Investors watching green energy demand, interest rate cuts, and geopolitical trends could find silver the sleeper hit of the commodities market.

Blog