Apple’s stock tanked 1.2% after a disappointing Worldwide Developers Conference in June 2025. The tech giant’s AI strategy focused more on privacy than on innovation. While Apple struggles to meet an already low bar, Amazon, Microsoft, Meta Platforms and Google have made bold moves in LLMs and enterprise solutions.

Where Apple’s AI Offerings Have Disappointed Users

AI-powered voice assistant: Siri has limited capabilities, focusing on Apple devices. Despite having a head-start, Siri is not good with foreign accents. Google Assistant recognises different accents, understands the context and excels at answering complex queries.

GenAI: Apple Intelligence combines GenAI with a user's personal context (like their calendar, contacts, and usage patterns). Users report inaccuracies in the leading feature - notification summaries. News summaries are known to generate misinformation.

Why is Apple Failing at AI?

Apple is limited by its ecosystem, while Google and Amazon have built ecosystems that touch various aspects of everyday life.

AI cannot be perfected in a closed ecosystem, which is what Apple has built its reputation on. AI systems require vast amounts of data, public testing, and continuous version launches.

Perhaps the most limiting factor is that Apple takes its commitment to user privacy very seriously. This has hindered AI development by limiting the amount of data it can use for training AI models.

Apple’s AI features have been hugely delayed, as the company has a culture of perfecting user experience before launching something.

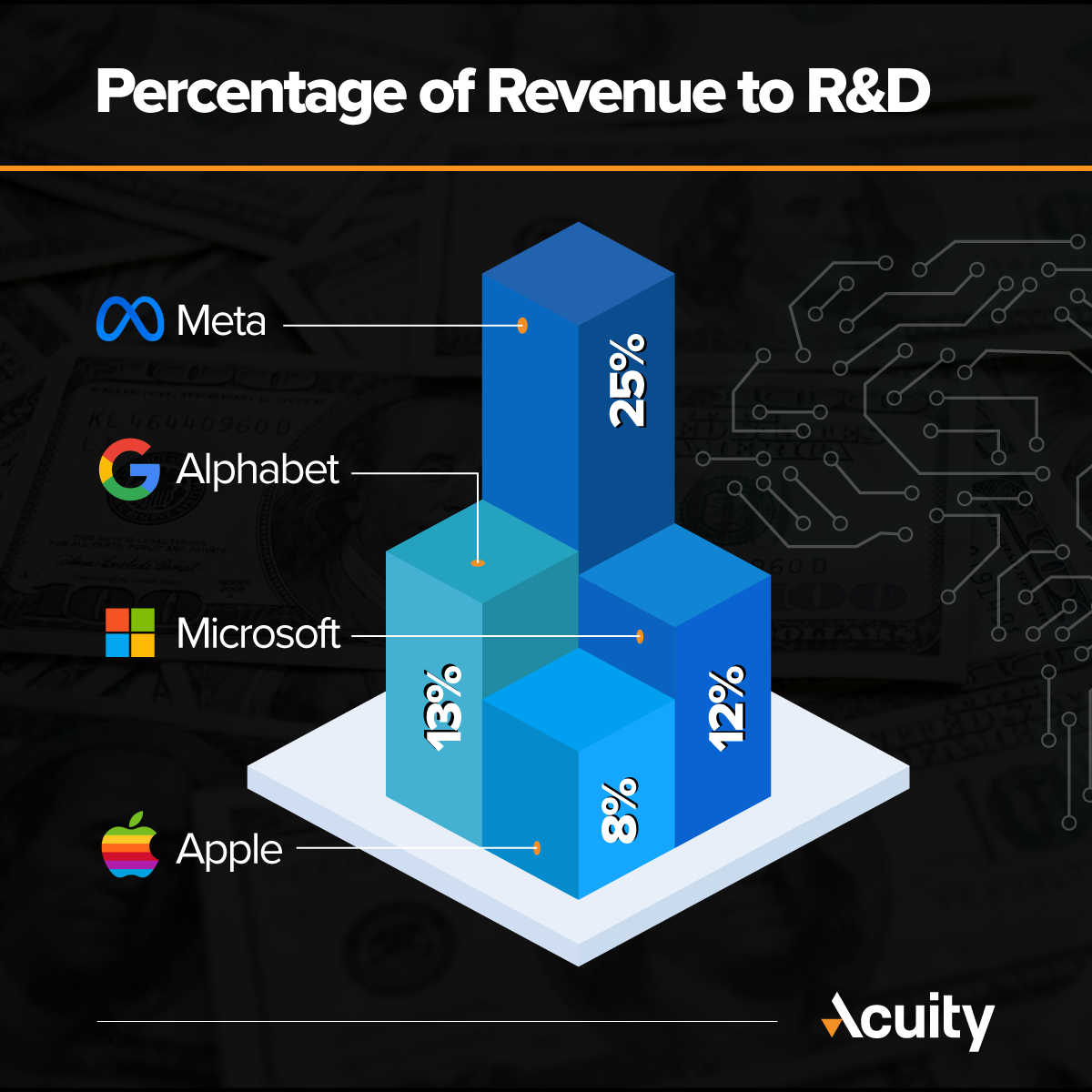

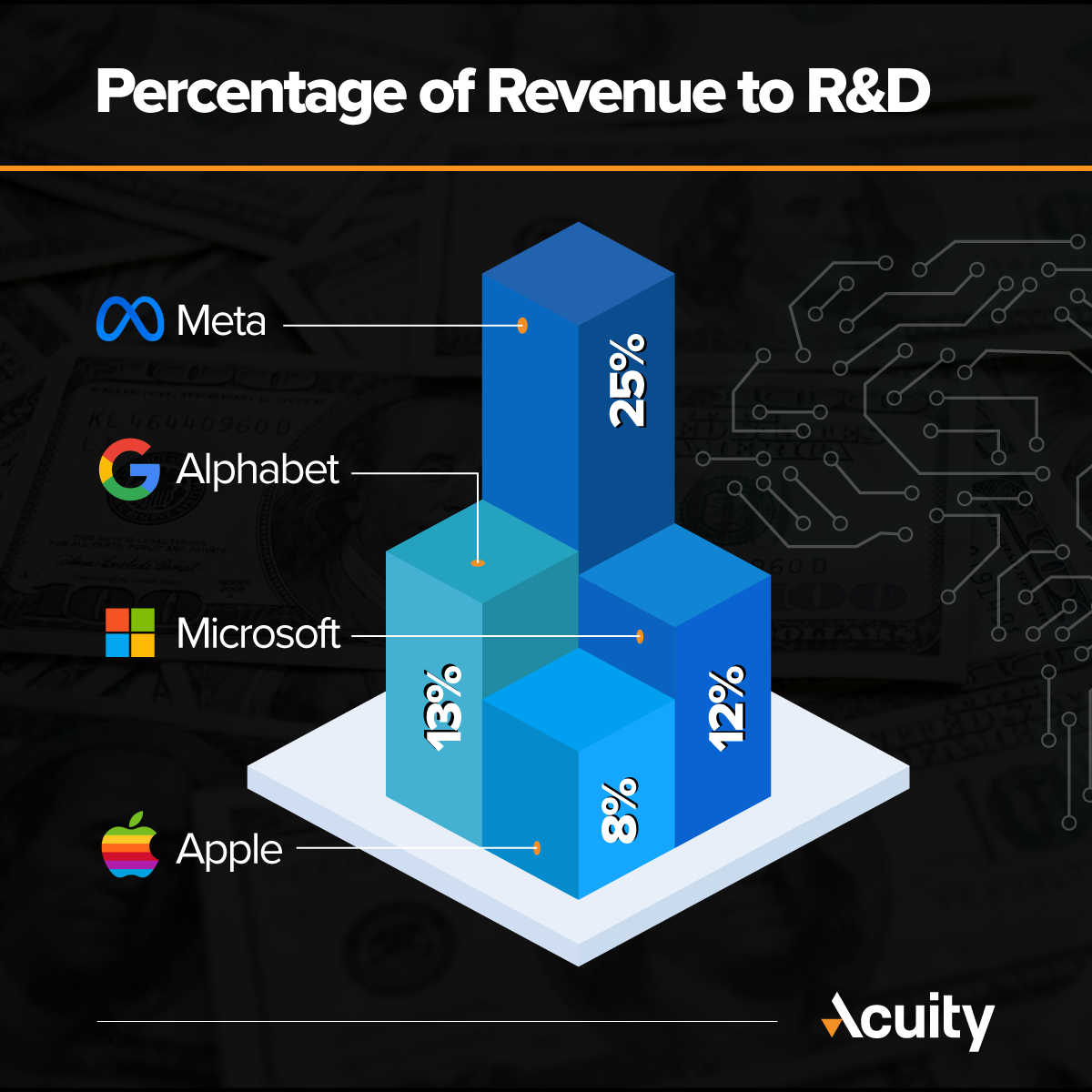

The iPhone maker dedicates less than 10% of its revenue to R&D. The funds are spread over developing new hardware, operating system upgrades and services.

Share Price Performance

AI stocks drove the stock market momentum in the first half of 2025. Nvidia’s market cap peaked at over $4 trillion on July 14 as companies raised their AI spend.

From January to July 2025, shares of the top tech firms:

- Apple: down almost 14%

- Amazon: up 1.35%

- Microsoft: up almost 22%

- Meta Platforms: 17.30%

- Google-parent Alphabet: down 3%

Investors and Apple leadership alike seem to be evaluating whether the company’s conservative AI approach would be a strategic advantage or lead to market share losses.

What to Watch

- Acquisition of AI startups by Apple

- Change in leadership

- AI-related regulations

- US-China rivalry (remember the DeepSeek market shock?)

While the battle of titans does take centre-stage, tier-2 AI companies are making big moves. These include companies spanning different industries, like Intuitive Surgical (biotechnology), Verint Systems (workplace management), C3.ai (corporate predictive analysis), Innodata (Insurance, healthcare), and SoundHound AI (voice AI).

Blog