Our Technology

Structuring the Unstructured

NLP Technology

Acuity’s NLP algorithms, powered by advanced machine learning models, enable the extraction of meaningful information from unstructured data. Through techniques like topic modelling, sentiment analysis, and named entity recognition, our technology identifies and categorises key elements within the text, converting it into a structured format that can be easily analysed and integrated into trading platforms and strategies. This capability not only enhances the efficiency of data processing but also unlocks valuable insights from vast amounts of unstructured information, fostering better decision-making and understanding.

Multiple NLP Methodologies

We use different methodologies for analysing financial markets to ensure accuracy, comprehensiveness, and adaptability. This approach allows analysts and investors to extract meaningful insights from the diverse and dynamic landscape of financial market data. Examples of our methodologies include:

- Lexicon Based Method

- Machine Learning Method

- Price Condition Method

- Syntactic Method

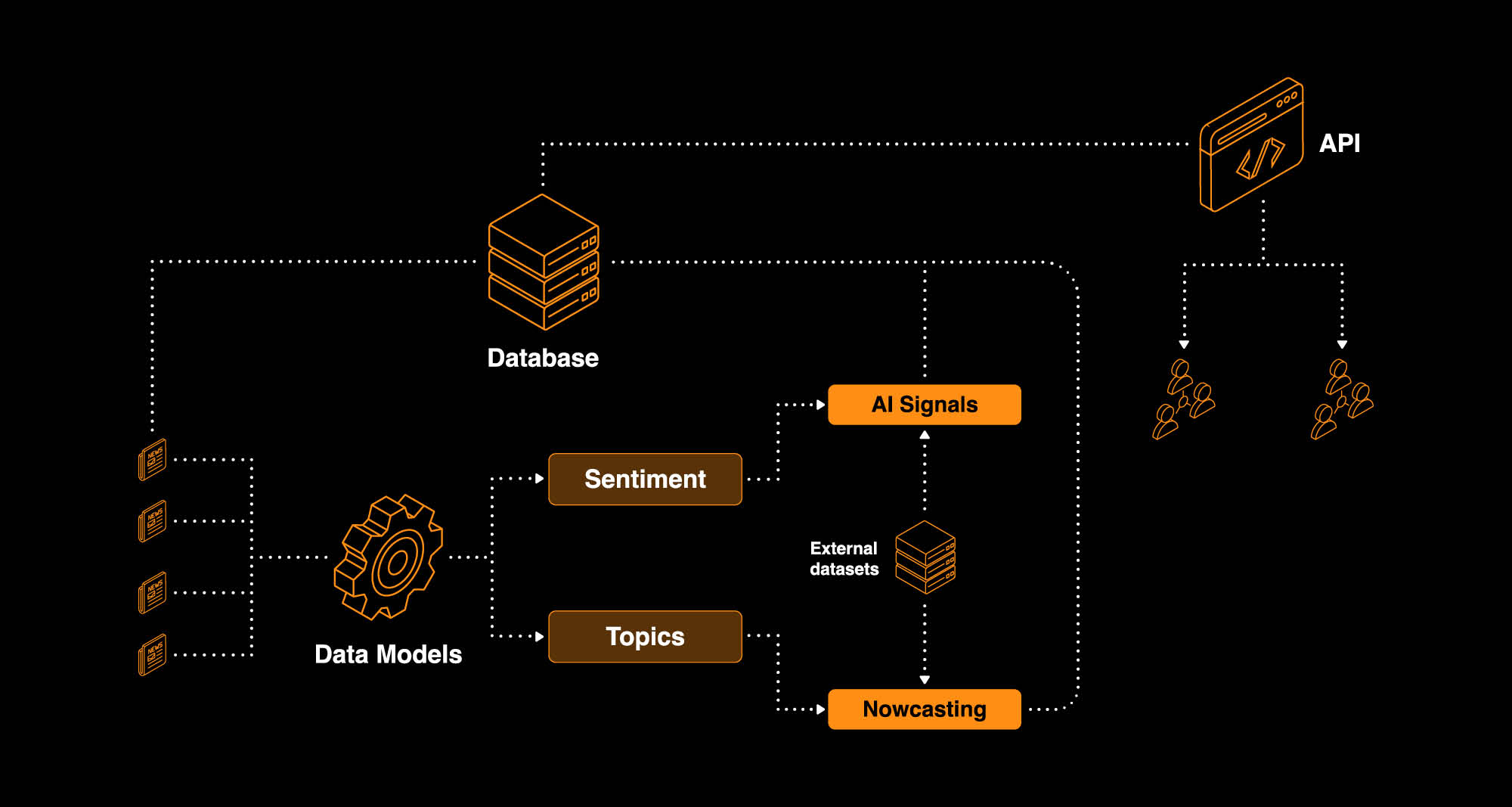

Simplified access to financial news data and content

Aggregation

We ingest content from high-quality sources including licensed, gated content and web and social media sources.

Discovery

Our comprehensive data characterisation and screening capabilities helps you to surface what matters the most, when you need it.

Analysis

We have over 45 million data points for analysis. Our research papers, historical archives and data visualisations are available to help you to find your competitive edge.

Delivery

Data visualisations, real-time APIs and multi-channel distribution options available to reach investors where they want to be.

Flexible Integration Options

FAQs

Explore answers to common questions about our products, services, and policies in this comprehensive Frequently Asked Questions (FAQs) section:

How does alternative data help investors?

Alternative data empowers investors with a broader and more dynamic set of information, enabling them to make more informed decisions, manage risks effectively, and potentially gain a competitive advantage in the market.

Why is it important to use unstructured data in a trading strategy?

Unstructured data in the financial markets is powerful because it offers a more holistic, timely, and nuanced understanding of market conditions, sentiments, and emerging opportunities, allowing investors to make more informed decisions and gain a competitive edge.

Do I need to be a quant to use your data?

While quantitative skills can be advantageous for certain aspects of working with alternative data, it is not a strict requirement. Our retail trader-friendly tools provide intuitive, visual interfaces for accessing and using alternative data in your trading decisions.