Product updates

May 2025

Enhancing Transparency and Insights with Signal Performance in APIs

Providing traders with actionable insights and transparent data is at the core of what we do. To expand upon this commitment, we’re pleased to announce a significant update to our Signals REST API and WebSockets API: the inclusion of Signal Performance metrics in the API response.

Bridging Web and API Functionality

We’ve offered signal performance visibility in the web versions of our tools for some time, a feature that has been met with widespread enthusiasm among traders. By clearly showcasing the best-performing trade ideas, users have been able to make more informed decisions and refine their trading strategies.

Now, we’re extending this critical functionality to our API, enabling brokers and platform providers who retrieve data via our API to deliver the same level of insight directly to their users. This update empowers brokers to display performance metrics front and centre in their own platforms, creating an improved trading experience while further enhancing user engagement.

Comprehensive Signal Performance Data

The inclusion of Signal Performance data in our APIs provides a detailed look at trade idea outcomes across multiple time frames. Specifically, the performance metrics include:

- Overall Performance: A comprehensive view of the performance of trade ideas for a specific instrument, enabling users to identify consistently profitable opportunities.

- Most Recent Performance: An analysis of the latest 10 trades, helping users focus on short-term trends and evaluate signal effectiveness in real-time trading conditions.

- Monthly Performance: Aggregated metrics presented on a monthly basis, offering insights into long-term patterns and strategy sustainability.

These metrics provide users with a holistic view of trade idea performance across different time horizons, offering both tactical and strategic advantages.

Why This Matters to Brokers and Traders

This enhancement to our API equips brokers with the means to deliver:

- Improved decision-making: Transparently showcasing which trade ideas perform best over varying time frames.

- Customisable user experiences: Building platforms that highlight actionable insights for diverse trading styles.

- Competitive differentiation: Providing tools that foster engagement, trust, and long-term loyalty from traders.

May 2025

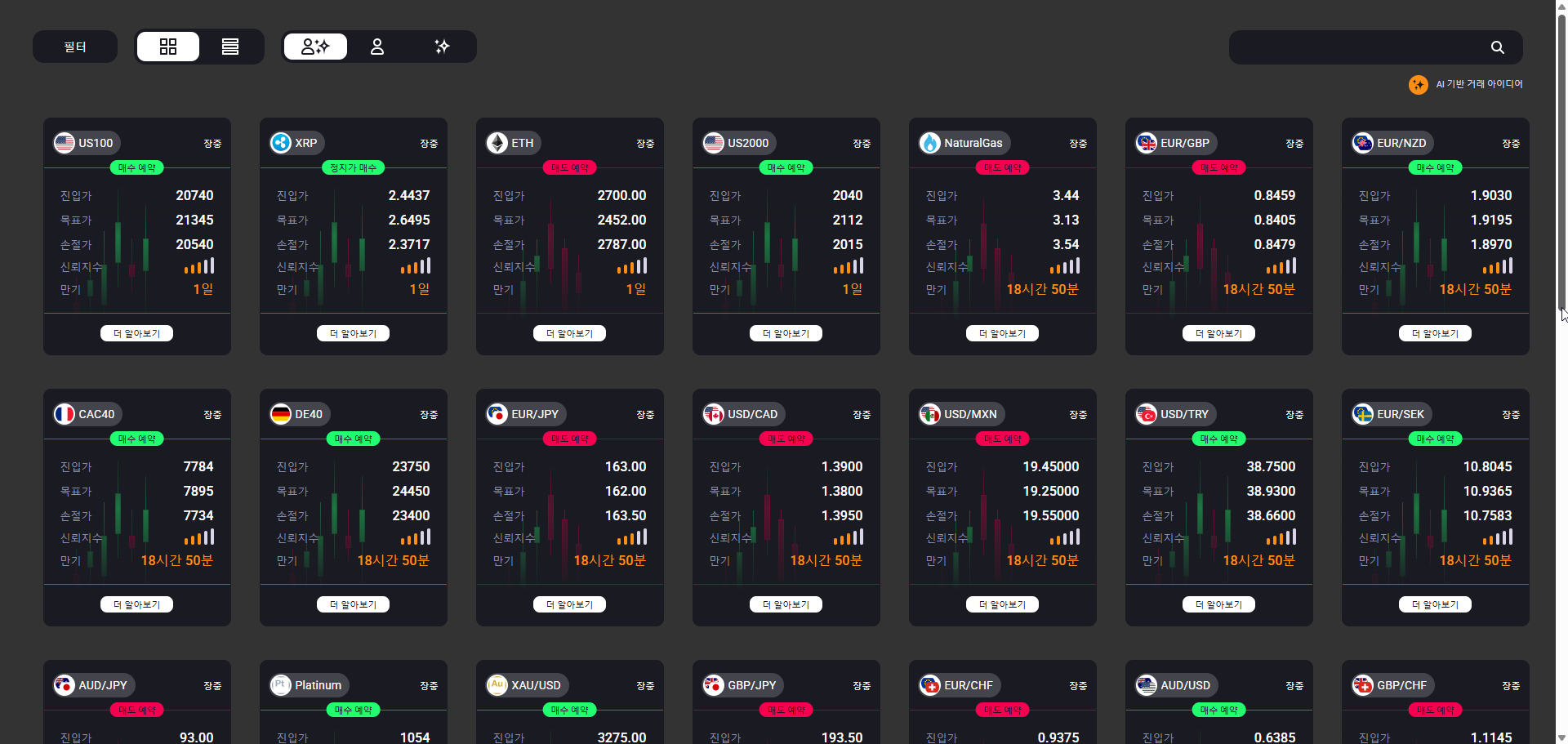

Korean Language Signals in AnalysisIQ and Signal Centre

As the trading industry continues to globalise, catering to regional markets with tailored and accessible tools has become a critical factor for brokers aiming to stay competitive. In response to the growing demand from the Korean market, we are pleased to announce the addition of Korean language signals to our AnalysisIQ, Signal Centre, and consequently, the Research Terminal product suites.

Unlocking Opportunities in a Rapidly Expanding Market

The Korean trading audience has experienced steady and notable growth in recent months, with brokers increasingly focusing on this dynamic region. By equipping our tools with Korean-language trade signals, we empower brokers to deliver relevant, timely, and actionable trade ideas directly to their clients in the local language.

This update reinforces our commitment to supporting brokers as they penetrate new markets, ensuring they can meet the linguistic and cultural expectations of their growing user base. From enhancing engagement to promoting trust, offering content in a trader’s native language is an essential step to driving customer satisfaction and retention.

Enhancing Broker Competitiveness with Localised Insights

For brokers, targeting the Korean market involves more than simply offering access to popular trading instruments. By providing localised and relevant insights, brokers can:

- Position themselves as partners that truly understand regional traders' needs.

- Drive higher engagement through signals delivered in an accessible format.

- Strengthen trust and brand loyalty in a competitive landscape.

This update ensures that brokers can deliver a premium trading experience that aligns with the strategic goals of Korean traders.

May 2025

Enhanced Trading Accessibility with Web Integration

In line with our commitment to enhancing trading experiences, we’re excited to announce a major update to our product suite: the ability for traders to execute trades directly from our tools when integrated into brokers' websites, such as through their Client Portals or other interfaces.

Expanding Trading Possibilities Beyond Platforms

This new functionality complements trading through established platforms like MetaTrader and cTrader, by enabling trading directly via brokers’ web environments. Instead of being confined to the interface of third-party platforms, brokers can now integrate our tools to provide a unified, web-based trading experience that works seamlessly across desktop and mobile devices.

What sets this apart is its ability to operate alongside existing MetaTrader or cTrader setups, allowing brokers to enhance their offering without disrupting their current trading ecosystem. This dual support expands reach, giving brokers and traders flexible options across multiple platforms.

Unleashing the Power of Mobile-First Trading

One of the most compelling enhancements brought by this update is the support for mobile-first trading. Unlike MetaTrader, where custom tools cannot be integrated into the mobile app, our solution allows users to access trading tools from anywhere – directly through their broker’s mobile-friendly websites or applications. This ensures that traders can operate efficiently on-the-go, bridging a critical gap in the evolving needs of mobile-first users.

Benefits for Brokers and Traders

This update brings significant value to both brokers and traders:

- For Brokers: With trading now facilitated on brokers' websites, the potential to attract a broader audience and improve user engagement is immense. This can directly translate into increased trading volumes while enabling brokers to deliver a tailored user experience.

- For Traders: The convenience of executing trades through an accessible and intuitive interface, without the need to rely solely on desktop platforms, empowers traders to make decisions swiftly – whether at their desks or on their phones.

May 2025

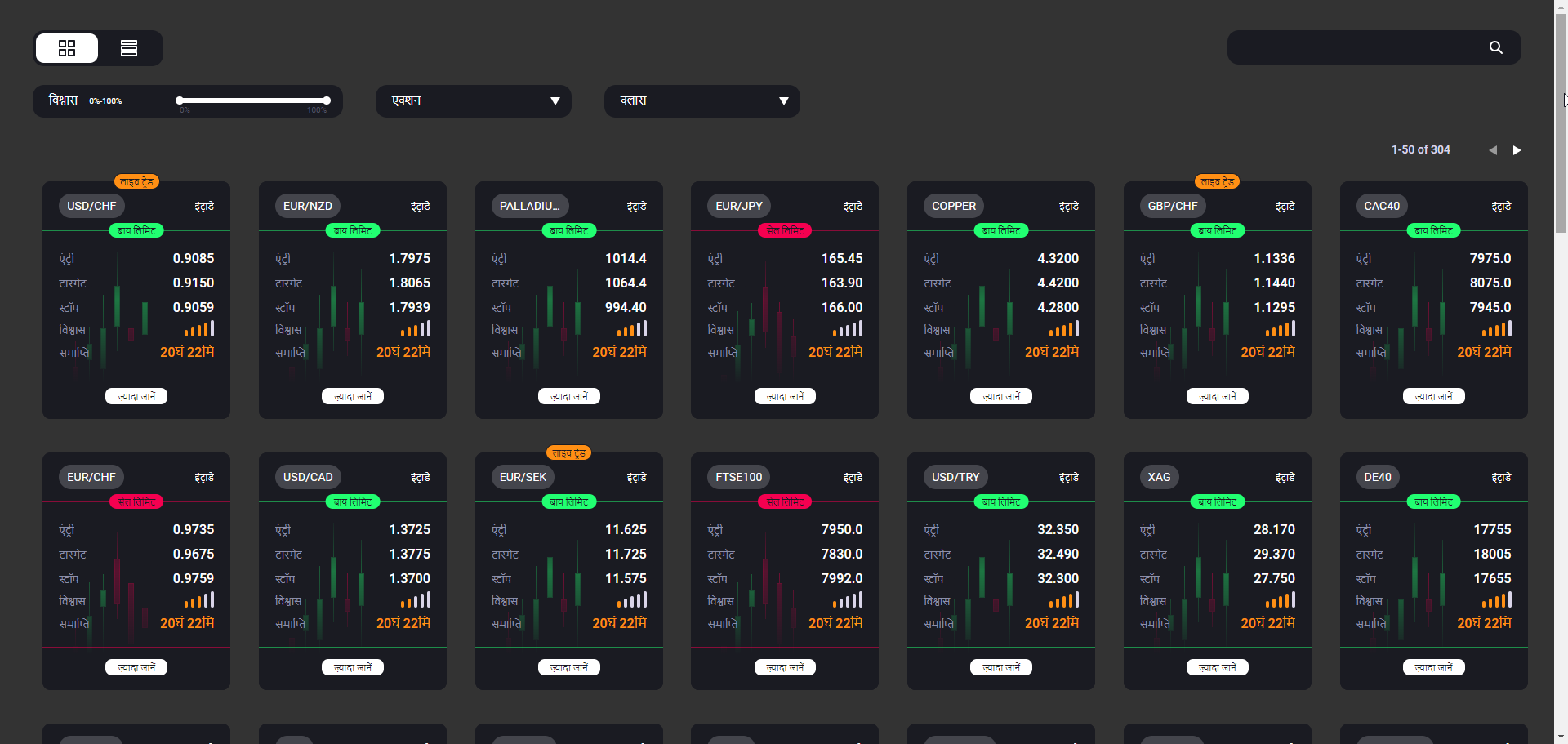

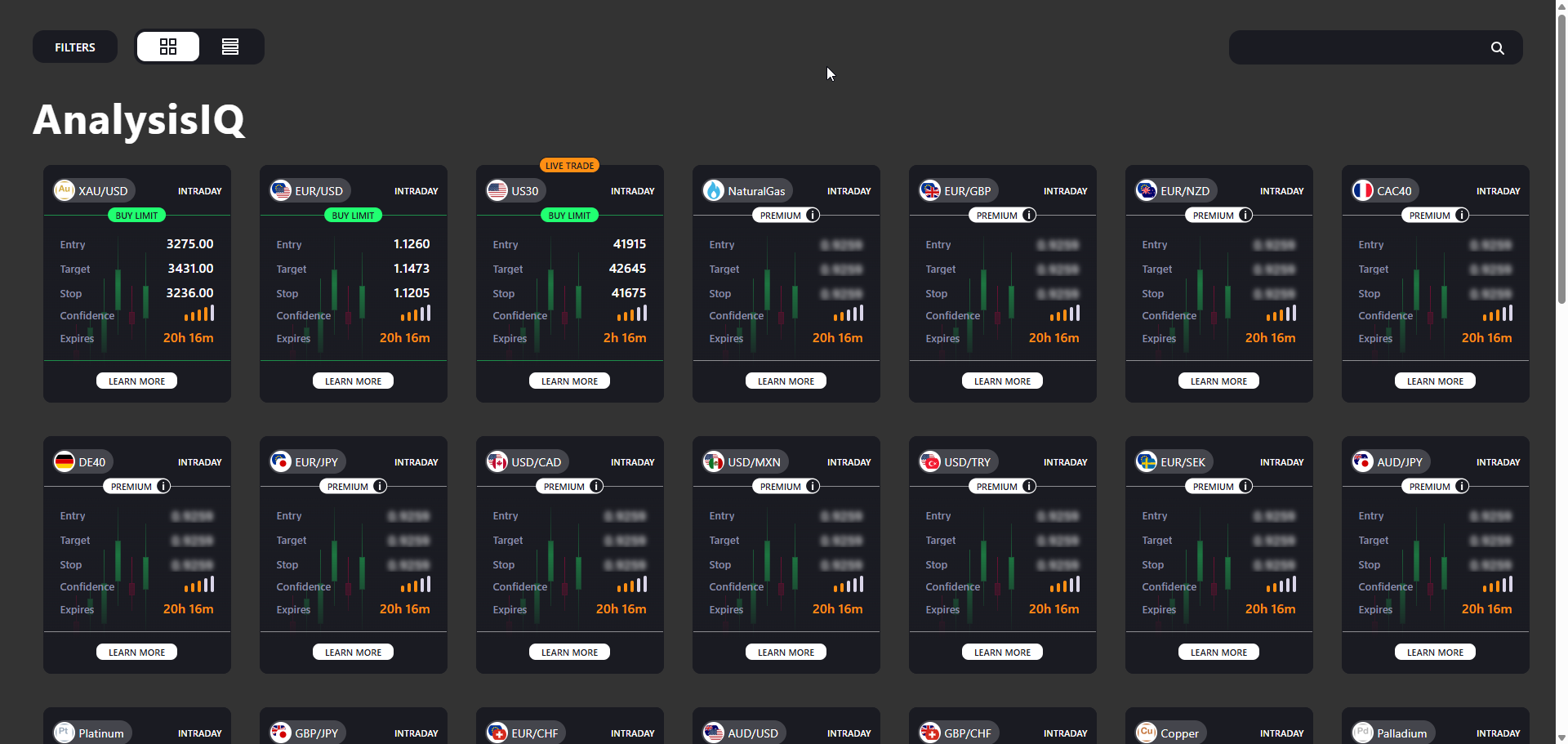

Instrument Priority Settings for AnalysisIQ

To further enhance the flexibility and personalisation of AnalysisIQ we are excited to introduce a new Instrument Priority Setting feature. This update empowers brokers to define the order in which instruments are displayed across various sections of the platform, ensuring trade ideas for preferred assets are shown first.

What’s New?

Flexible Prioritisation

Brokers can now specify the priority order of instruments displayed in AnalysisIQ. For example, a user can assign EURUSD, GBPUSD, and USDCAD to appear first, ensuring these instruments are prioritised in both Tile and List views.

- Drag-and-Drop UI for Prioritisation: the update introduces a user-friendly drag-and-drop interface in widget settings, allowing for quick and intuitive adjustments to the priority order of instruments.

- Separate Controls for Asset Types: users can tailor instrument prioritisation for different tools independently.

Key Benefits

-

Focus on Popular Instruments

By prioritising popular instruments, brokers can strategically promote trade ideas for assets most relevant to their users, potentially driving higher engagement and trading activity. -

Optimised Freemium Experience

Freemium configurations can ensure active trade ideas are highlighted first while deflecting non-relevant ideas, maintaining a clean and impactful presentation for users operating within a limited scope of features.

Functional Details

Here are additional functional highlights of this update:

- Default Behavior for Unpublished Trade Ideas: if no trade ideas for prioritised instruments exist, AnalysisIQ defaults to its existing ordering logic (publication date, asset class, closed status). Expired ideas will not take precedence.

- Unlimited Prioritisation: brokers can select as many instruments as they wish to prioritise.

- Error Handling: a warning symbol alerts brokers if prioritised instruments are unavailable in a newly applied watchlist or due to permission removal.

Designed for Greater Control and Customisation

This feature is a direct response to customer feedback, giving you deeper control over how trade ideas and assets are presented across AnalysisIQ and related tools. Whether your focus is on promoting high-traffic instruments, refining freemium experiences, or integrating customised watchlists, this update ensures your insights are aligned with your goals.

May 2025

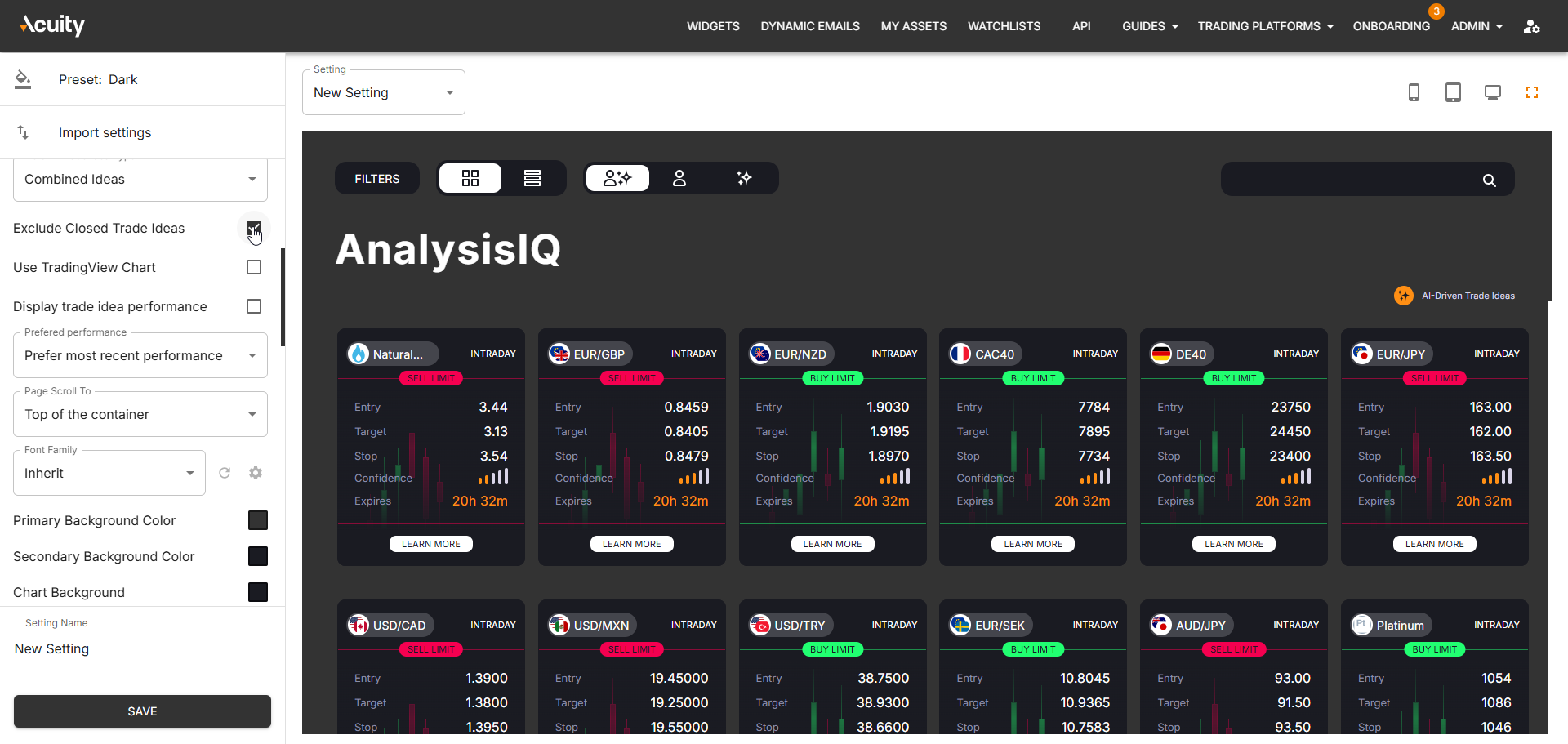

Enhanced Trade Idea Filtering for AnalysisIQ

In a continuous effort to optimize the user experience, we’re excited to announce an update to AnalysisIQ that enhances trade idea filtering. This latest feature allows users to easily hide expired or closed trade ideas, simplifying the view and ensuring that only live, actionable insights are presented.

What’s New?

Previously, users needed to manually select “Live Trades” and “Pending Trades” in the filter settings. With this update, users can now enforce this filtering as a default setting. This means expired or closed trade ideas are automatically excluded, streamlining the interface and reducing distractions for brokers, traders, and end-users alike.

Key Benefits:

-

Improved Relevance

By focusing exclusively on the latest active trade ideas, this update allows the AnalysisIQ tool to deliver highly relevant, up-to-date insights. This ensures users can concentrate on actionable opportunities without needing to navigate through outdated or irrelevant data. -

Optimized for Landing Pages

The enhanced filtering is particularly useful for brokers embedding the AnalysisIQ widget into landing pages. By default, these pages will now reflect only the most current trade ideas, enhancing the overall brand impression and user engagement. -

Enhanced Usability

Setting up the tool with this improved filtering reduces friction for users, ensuring a cleaner, more intuitive interface where only crucial trade ideas are presented.

Tailored for Brokers and Traders

This update is designed with both brokers and their clients in mind. Brokers can now configure AnalysisIQ to highlight only ongoing trade ideas, driving user engagement and reinforcing the credibility of their trading insights. Users, in turn, benefit from a streamlined experience that surfaces the information they care about most at just the right time.

January 2025

Introducing Multi Asset Dynamic Emails: Enhancing Personalised Communication

We are thrilled to announce the addition of Multi Asset Dynamic Email campaigns to our suite of Dynamic Emails.

This new feature takes user engagement to the next level, enabling brokers to include multiple instruments in a single email template, packed with curated, high-value information tailored to traders' needs.

What Does the Multi Asset Dynamic Email Offer?

The new Multi Asset Dynamic Email campaign type allows brokers to streamline communication while ensuring maximum relevance for their users. Instead of sending multiple emails for each instrument, brokers can now craft templates that consolidate information for several assets into one cohesive email.

These emails can include a range of valuable data for each instrument:

- Signals

- News Sentiment

- Economic Events

- Corporate Events

- News

- Associated Instruments

This rich, integrated format ensures that users receive actionable insights specific to the markets they care about—all grouped into a single, clear, and efficient communication.

Benefits of the Multi Asset Dynamic Email

-

Improved Engagement

In a world where inboxes are crowded, fewer emails with higher relevance lead to better open rates and increased user interaction. The Multi Asset Dynamic Email allows brokers to consolidate information and deliver exactly what users want in fewer touchpoints. -

Ultimate Campaign Flexibility

Both Single Asset and Multi Asset Dynamic Email campaigns are now available to brokers, offering unparalleled flexibility:- Opt for Single Asset campaigns to focus on niche market updates.

- Use Multi Asset campaigns for broader, multi-market insights—all within the same toolset.

-

Key Features for Maximum Impact

Just like the Single Asset Dynamic Emails, the new Multi Asset Dynamic Email campaigns are designed with advanced brokerage needs in mind:- Flexible Calls to Action (CTAs): Customise your CTAs to encourage user interactions, such as exploring instrument details.

- Freemium Restrictions: Control access by segmenting content for free users versus premium subscribers, enhancing upselling opportunities.

- Enhanced Template Clarity: Clean, well-organised templates for easy reading and seamless decision-making.

-

Seamless Integration

The integration process for Multi Asset Dynamic Emails is identical to the Single Asset campaigns. Brokers can add these campaigns to their workflow without delay, making the transition effortless and fast.

Why It Matters

In the trading space, timing and relevance are everything. The Multi Asset Dynamic Email not only helps brokers reduce the volume of daily communications but also ensures that each message delivers optimal value. By consolidating key data for multiple instruments into one email, traders receive personalised and actionable information without being overwhelmed.

At the same time, brokers gain a powerful tool to strengthen their relationship with users by providing consolidated, user-friendly insights—all while maximising operational efficiency.

January 2025

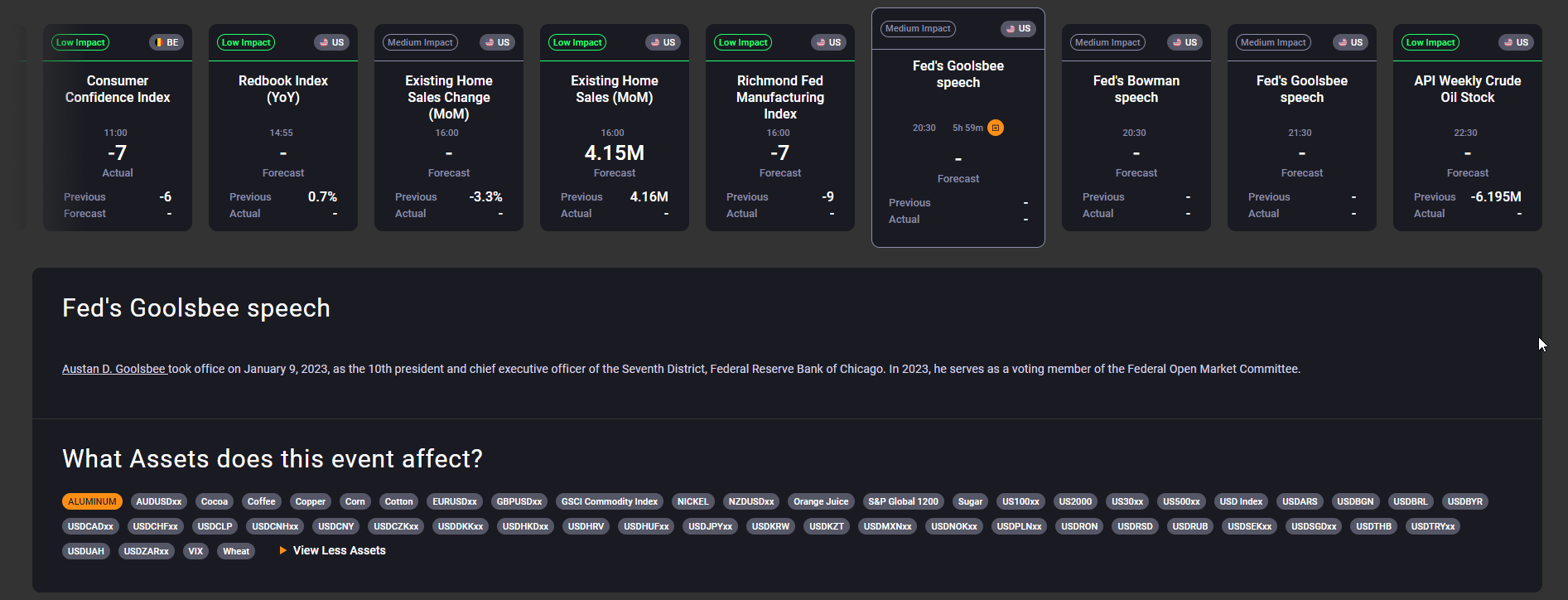

Introducing Actionable Trade Ideas in Economic and Corporate Calendars

In the ever-evolving world of FinTech, precision, and actionable insights remain pivotal to providing traders with the tools they need to succeed. Keeping this priority in focus, we are excited to announce a major update to our Economic and Corporate Calendars: the seamless integration of actionable trade ideas powered by AnalysisIQ.

This enhancement is designed to not only improve the utility of the calendars but also to empower traders with curated trade ideas tied to critical macroeconomic and corporate events.

How It Works

With this update, for every event—such as Nonfarm Payrolls, Consumer Price Index (CPI), GDP releases, or Earnings Reports—the Calendars now include trade ideas from AnalysisIQ. What makes this integration so effective is its timing: trade ideas are displayed only if their validity period aligns with the scheduled time of the macroeconomic event.

This allows traders to directly access actionable insights, precisely when they're most relevant, all within the existing tools they’re familiar with. For example, while accessing the Calendars via MetaTrader expert advisors, users can immediately see and potentially act upon actionable trade ideas tied to high-impact events.

Benefits for Brokers

For brokers, this integration represents a new level of flexibility. Those subscribed to both the Calendars and Signals services will have the option to enable this feature within their offering.

This opens up opportunities for creative user acquisition strategies. For instance:

- A version of the Calendars without trade ideas can be displayed before login to entice interest.

- The full version, enriched with actionable trade ideas, can be placed behind login credentials or gated in a way that incentivises specific user actions (such as funding an account or completing registration).

This scalable, modular approach allows brokers to differentiate their offerings and drive more meaningful engagement with their traders.

Why It Matters

In today’s fast-paced markets, traders need tools that not only inform but also guide. The integration of actionable trade ideas transforms static event calendars into dynamic instruments of insight. By providing timely, context-specific trade ideas, you help traders stay ahead of the curve and make better-informed decisions.

For brokers, this feature is more than just a tool; it’s a competitive advantage. By offering added value through actionable insights, brokers can strengthen customer loyalty, improve acquisition efforts, and stand out in an increasingly saturated financial services market.

January 2025

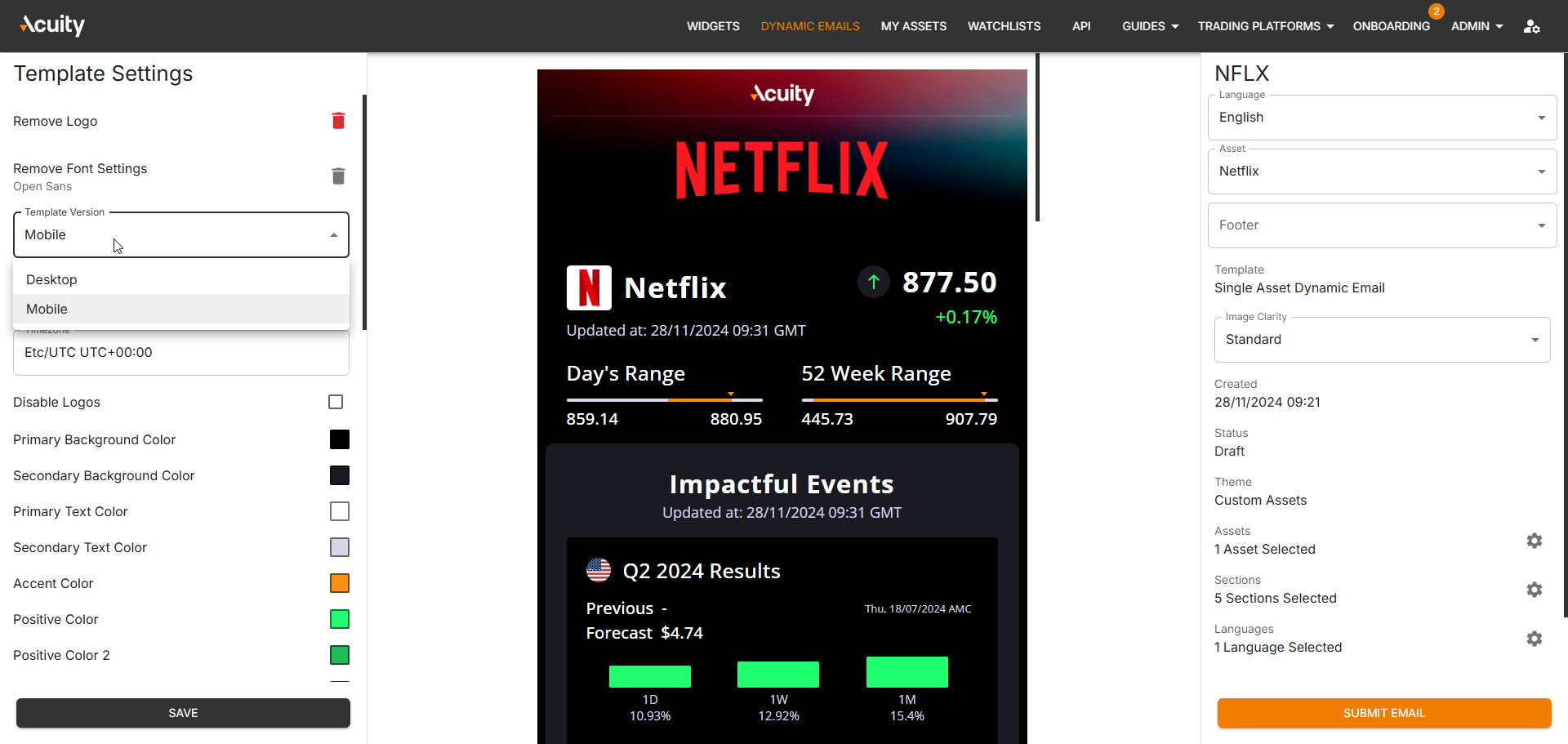

Improved Dynamic Emails Configuration: Bug Fixes and Enhanced Workflow

At Acuity Trading, we’re constantly improving based on user feedback, and we’re happy to share several updates to the Dynamic Emails configuration experience. These improvements address key pain points and refine the workflow for a smoother, more reliable experience.

Here’s what’s new:

- Template Style Fix: We’ve resolved an issue where the template style would reset after adjusting the Image Clarity parameter. Template edits will now remain consistent.

- Timezone Settings Correction: We’ve fixed a bug where the selected timezone wasn’t being saved after modifying an email template. Your timezone preferences will now persist as expected.

- Improved Save Workflow: If users click "Submit" without saving their changes, they will now be prompted to either save or discard their modifications. This ensures no adjustments are accidentally lost.

These updates reflect our ongoing commitment to incorporating user feedback and delivering a configuration experience that’s simple, reliable, and intuitive.

January 2025

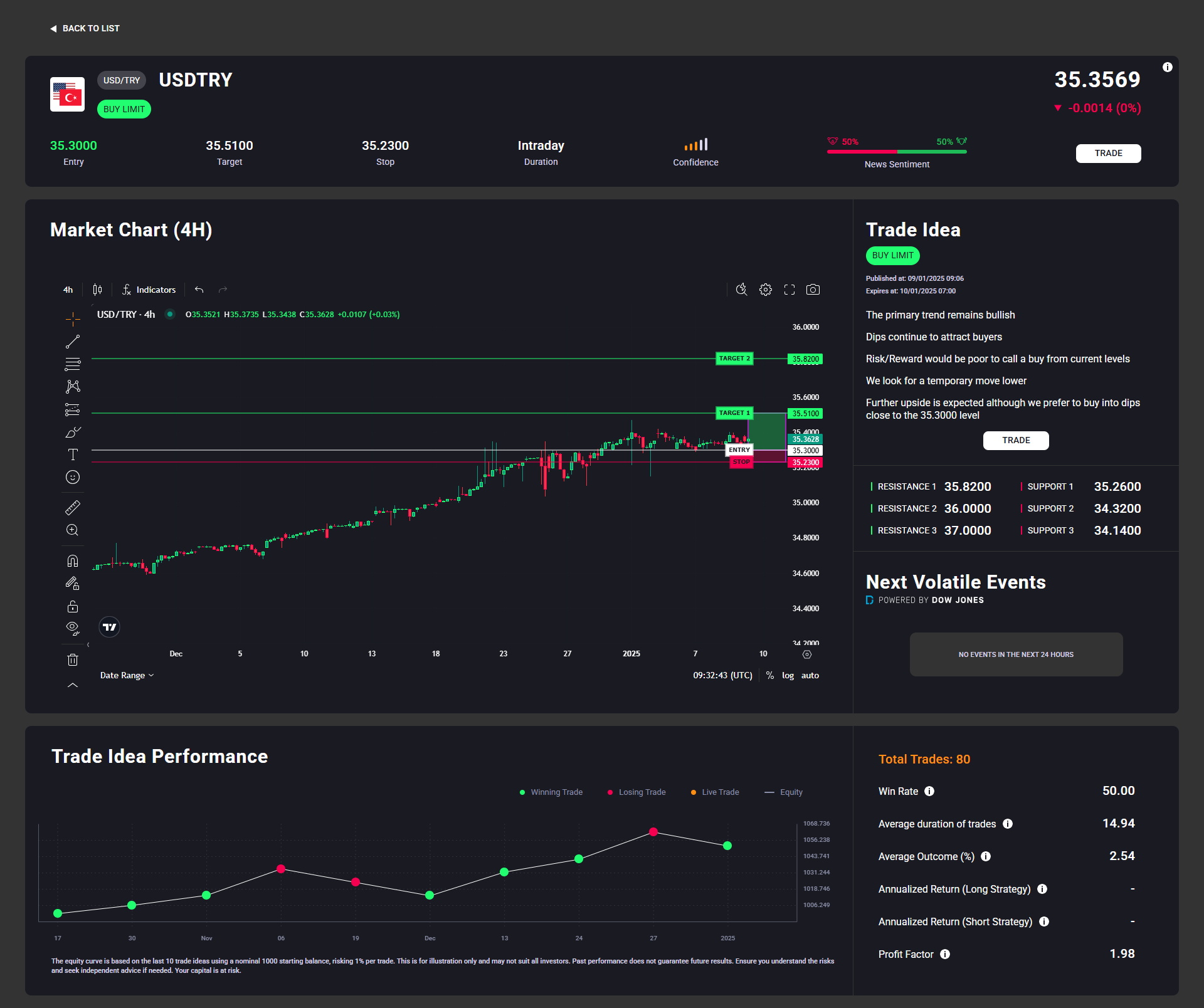

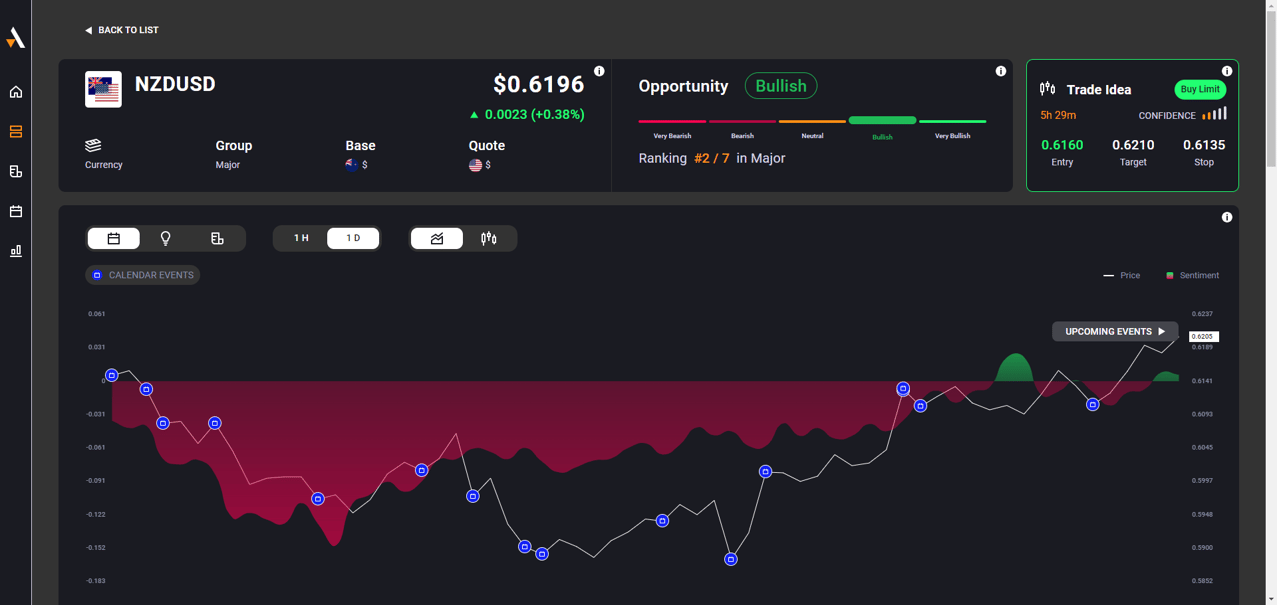

New in AnalysisIQ: Trade Idea Performance & Enhanced Filtering for Smarter Decision-Making

We’ve added a new feature to AnalysisIQ that provides a clearer view of trade idea performance, helping traders make more informed decisions. The platform now displays the performance of a selected trade idea over its last 10 trades, offering detailed insights into how specific instruments have performed recently.

Paired with existing filters for focusing on high-performing trade ideas, this upgrade gives traders the ability to quickly identify and prioritize the strategies that deliver the best results.

At the same time, it brings greater transparency to our data, allowing users to pinpoint underperforming strategies, reinforcing the importance of incorporating solid risk management practices into their workflow.

This update is all about empowering traders with the flexibility and insights needed to refine their strategies, focus on what works, and continuously improve performance.

This functionality can be enabled upon request. If necessary, multiple versions of the tool can be running at the same time, allowing for display variety tailored to different types of traders.

November 2024

Introducing Mobile-Optimised Templates in Dynamic Emails

We are pleased to announce a new feature in our Dynamic Emails editor: the option to select a mobile-optimised version of your email templates. Understanding that today's audiences frequently access content via mobile devices, this update ensures that your communications are as effective on small screens as they are on desktops.

Key Features of the Mobile-Optimised Template

-

Enhanced Mobile Experience: While our original templates are mobile-friendly, the new mobile-optimised option is specifically designed to address content display issues on smaller screens. This facilitates better readability and interaction, especially for content such as news updates.

-

Consistent and Concise Layout: The mobile-optimised template maintains the same data-oriented and concise content sections found in the desktop version. This ensures that key details are effectively communicated regardless of the device being used.

-

Seamless Activation: Brokers can easily enable the mobile-optimised template within the Dynamic Emails campaign editor, making the process straightforward and efficient.

This enhancement underlines our commitment to delivering flexible and audience-centric tools that ensure your message is conveyed effectively across all devices. Activate the mobile-optimised template today to enhance your communication strategy and reach your audience where they are.

November 2024

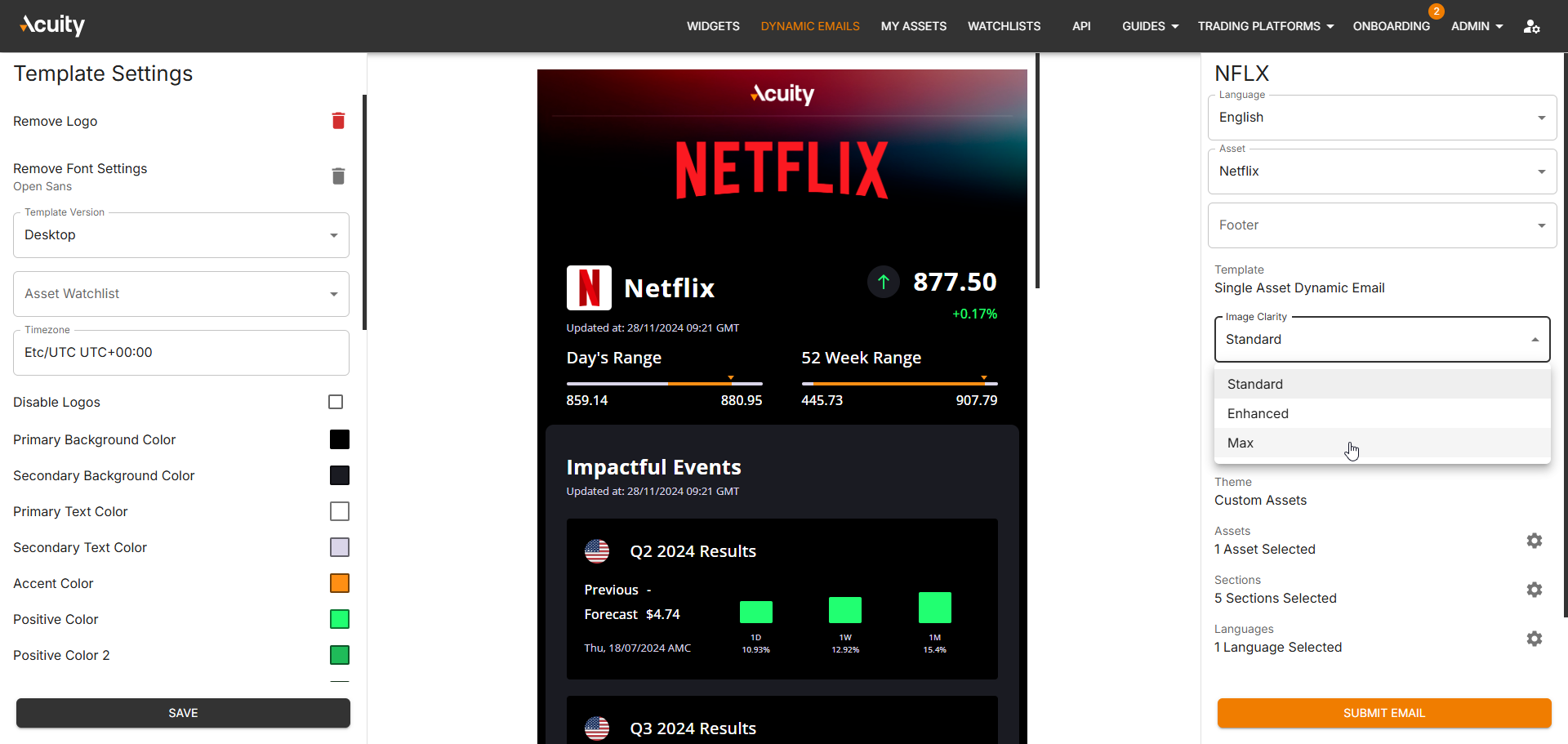

Enhancing Image Clarity in Dynamic Emails: New Options for Optimal Resolution

We're excited to announce an enhancement to our Dynamic Emails editor: brokers can now choose from three distinct options for image clarity, ensuring that visual elements in emails are optimized for clarity and impact.

New Image Clarity Options

-

Standard: This default setting offers balanced image quality and file size, suitable for general purposes.

-

Enhanced: This option improves image resolution, making visuals crisper and more detailed. It strikes a balance between image quality and performance, making it ideal for communications where image clarity is key.

-

Max: For scenarios requiring the utmost detail, the Max option provides the highest available resolution images. This setting is perfect for emails where precision and clarity of data points are critical.

While these options influence the image file size within the templates, they significantly enhance the user experience by ensuring all data points and visuals are presented with exceptional clarity.

This update empowers brokers to tailor their email visuals to match the context and importance of the message, all while delivering a professional and polished presentation.

November 2024

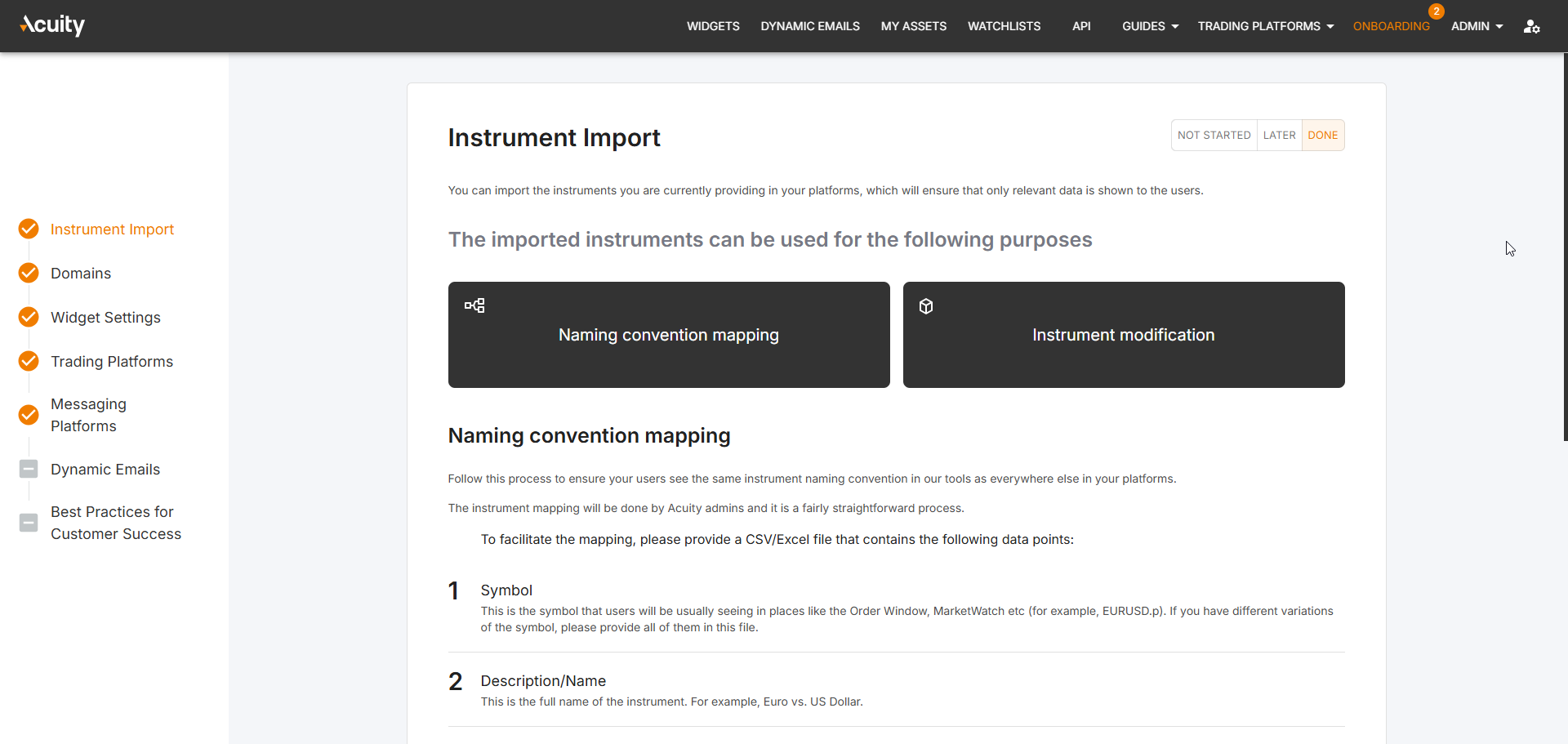

Streamlining Integration with Our New Onboarding Dashboard

We're pleased to introduce a dedicated onboarding page within our dashboard, designed to facilitate a seamless integration experience for brokers adopting our services. This comprehensive resource aims to streamline the onboarding process, ensuring a swift and efficient launch of our tools on broker platforms.

Key Features of the Onboarding Page

-

Step-by-Step Instructions: The onboarding page guides brokers through the integration process with a detailed, sequential outline of tasks. This structured approach minimizes confusion and accelerates onboarding.

-

Rich Media Support: To enhance understanding, each step includes illustrative images, informative videos, and direct links to our Knowledge Base resources. This multi-format support ensures brokers have access to all necessary information in a clear and accessible manner.

-

Real-Time Transparency: The inclusion of the onboarding process directly within the dashboard offers brokers peace of mind by clearly outlining all required steps before launching. It also provides our team with insights into the onboarding status, enabling us to identify and address any issues promptly.

-

Enhanced Broker and Trader Experience: By expediting the onboarding process, brokers can offer our tools to traders more quickly, enhancing the value and usability of their platforms.

Our new onboarding page is a significant leap forward in improving the broker integration experience, providing clarity and reducing the time to market for our clients. Explore the new onboarding dashboard today, and benefit from its comprehensive guidance tailored for a successful launch.

November 2024

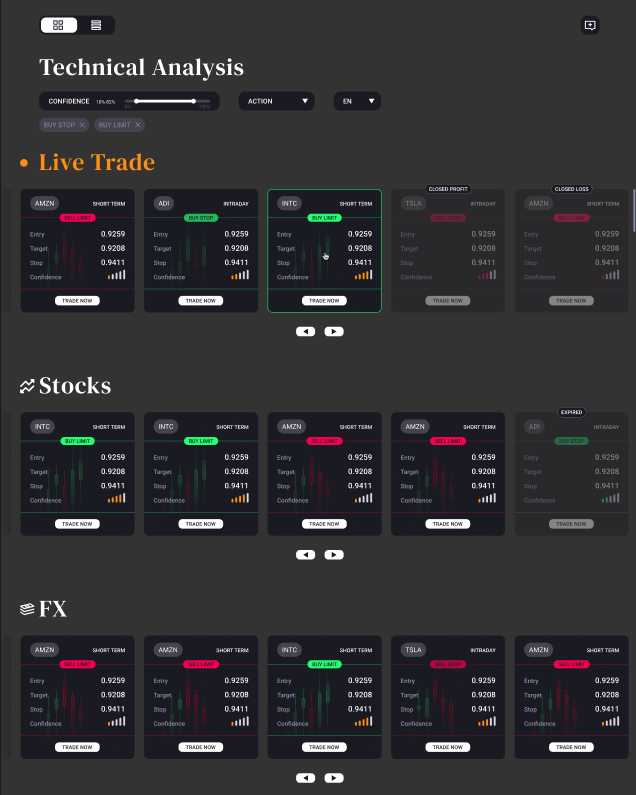

Introducing Enhanced Trade Idea Filtering: Confidence, Performance, and Live Status Updates

We’re excited to announce a set of streamlined updates to our trade ideas tool, aimed at enhancing the precision and usability for traders. These updates focus on three major areas: Confidence, Performance, and Live Status.

Here is a breakdown of what's new.

Confidence Filter

Our confidence filter has been simplified, allowing traders to easily select the minimum confidence level for displaying trade ideas. The confidence score, derived from a combination of parameters such as Instrument Price Trend, News Sentiment, Volatility, and News Volume, ensures that each trade idea aligns with market indicators. The updated filter options include:

- >=20% Confidence: Displays all trade ideas with over 20% confidence.

- >=40% Confidence: Filters to show only ideas with over 40% confidence.

- >=60% Confidence: Narrows down to ideas with over 60% confidence.

- >=80% Confidence: Restricts display to trade ideas with 80%+ confidence.

Selecting a higher confidence level ensures that the ideas presented are more aligned with current market trends and sentiments.

Performance Filter

To help traders focus on high-quality trade ideas, we’ve introduced a new performance-based filtering component, with options to select based on historical performance:

- Top Performers: Displays ideas with a win rate over 50% in the past 10 trades.

- Underperformers: Returns ideas with a win rate below 50% in the last 10 trades.

- Custom Win Rate: Allows traders to set a custom win rate using historical data from 2021 onwards.

- Custom Profit Factor: Traders can customise the profit factor, calculated by dividing total gains by total losses, enhancing the focus on profitability.

This addition empowers traders to concentrate on strategies with historical success, tailoring their approach based on individual trading preferences.

Live Status Filter

Our new live status filter improves real-time trade management by allowing you to choose the display status of trade ideas:

- Pending Trades: Active ideas yet to hit their entry levels.

- Live Trades: Ideas that have reached their entry levels and are progressing toward take profit or stop loss.

By selecting both options, expired trade ideas will be filtered out, providing a cleaner and more focused view.

Incorporating these updates, our tool is now more robust, providing a sophisticated means of filtering and focusing on trade ideas that match your trading strategy and risk profile. Explore these new features today and enhance the accuracy and efficiency of your trading decisions.

September 2024

Introducing an option to disable logos for Compliance in various regions

We are committed to ensuring that our Research Terminal is fully compliant with regional regulations worldwide. Following valuable feedback regarding legal restrictions in Jordan, we have introduced a new feature across the Acuity Research Terminal and its associated services.

What's New:

- Disable Logos Setting: Users can now find a "Disable Logos" checkbox within the settings of all Research Terminal widgets—both standalone and combined. This feature is essential for adhering to the legal requirements in Jordan that prohibit the display of stock logos in trading applications.

- Extension to Dynamic Emails: This setting is also implemented in Dynamic Emails to ensure all outbound communications remain compliant without manual oversight.

This update is part of our ongoing effort to adapt our services to meet the specific legal and regulatory requirements of each region we operate in.

For instructions on how to activate the "Disable Logos" feature, users are encouraged to refer to the settings section of their Research Terminal or consult the help documentation available online.

September 2024

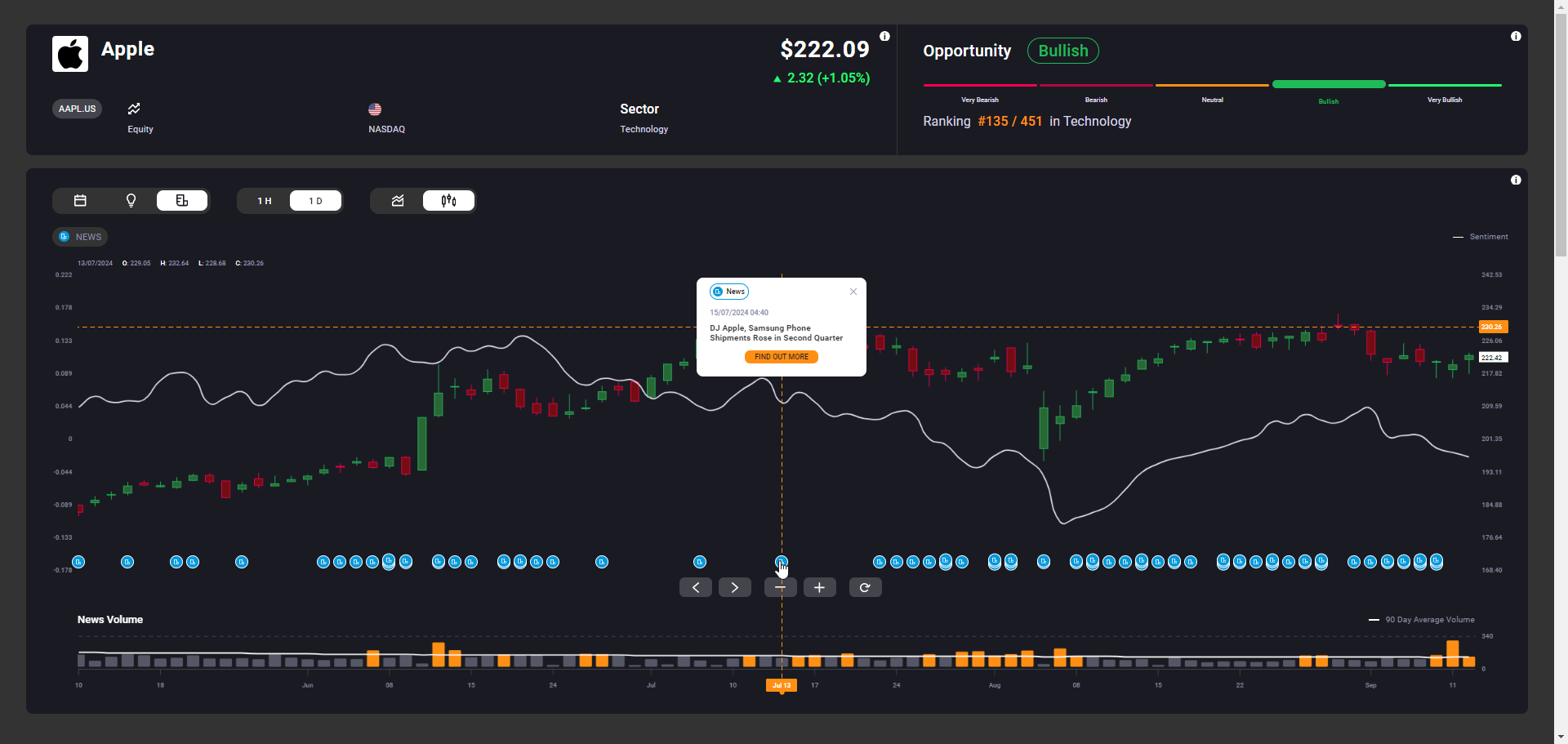

Introducing Enhanced Event Display on Candle Charts in AssetIQ

We are excited to announce a significant update to AssetIQ's charting capabilities that responds directly to user feedback. Previously limited to line charts, event displays—including calendar events, market alerts, and news—can now be viewed on candle charts as well.

Key Update Features:

- Expanded Chart Compatibility: Users can now access event information on both line and candle charts, ensuring that those who prefer different types of charting do not miss out on critical data.

- Improved Data Access: This update allows for a more comprehensive analysis environment, providing all users, regardless of their chart preference, with the ability to see and utilize all available event data directly on their preferred chart type.

This enhancement is part of our ongoing commitment to refining our platform and providing a more versatile and user-friendly experience. By enabling event displays on candle charts, we are ensuring that all AssetIQ users can leverage the full analytical power of the platform, enhancing their decision-making process in dynamic markets.

For more information on how to utilize the new candle chart event displays, users are encouraged to visit the updated tutorial section within AssetIQ or contact our support team. We look forward to your feedback and are dedicated to continuous improvements based on your insights.

September 2024

Enhanced Communication Tools: New Disclaimer Feature for Signal Messages

We are pleased to announce an important update to our messaging system on both Telegram and Discord channels. In response to feedback from our brokers, we have introduced a new feature that allows for the inclusion of disclaimers in every message sent. This update is designed to enhance transparency and compliance across communication channels.

Starting immediately, customizable disclaimers can easily be added to messages distributed through Telegram and Discord. For example, a common disclaimer such as “All trading involves risk” can now be automatically appended in italics at the bottom of each message, right under the market chart.

Key Features:

- Customizability: any disclaimer text can be added by the Acuity team. We have also added support for different languages. The disclaimer will arrive in the language of the report.

- Ease of Use: adding disclaimers can be done in the matter of minutes.

- Flexibility: If no disclaimer is desired, the field can be left empty, and no text will be appended to messages.

This update underscores our commitment to providing tools that not only enhance the functionality of our services but also ensure compliance with trading regulations. We understand the importance of clear and responsible communication in trading environments, and we are dedicated to continuous improvement based on the feedback of our users.

We invite you to make use of this new feature and look forward to your feedback to further refine and enhance our services.

August 2024

New Multilingual Capabilities for Call to Action Text in the Research Terminal

We are thrilled to announce an enhancement to our Research Terminal, aimed at enriching user engagement across global markets. Recognizing the diverse linguistic needs of our customers, we are preparing to introduce a feature that allows Call-to-Action (CTA) text to be translated into multiple languages.

Currently, the Research Terminal and its components require users to input the specific text that will appear in the widget as the CTA value, limiting the CTA’s effectiveness to only one language. To address this, we have integrated the capability to use a phrase identifier as the value for the CTA text. This advancement will enable the automatic translation of CTA text into all languages supported by the widget, ensuring a wider and more inclusive reach.

This feature builds on the successful implementation of multilingual support in other areas of our platform, such as the AnalysisIQ and other tools primarily used in MetaTrader, and also in the Dynamic Emails CTA Text field.

By enabling multilingual translations, we aim to empower our users to communicate more effectively with their global audience, enhancing user interaction and engagement through tailored, language-specific CTAs.

Stay tuned for more updates as we continue to develop and refine this feature to meet the evolving needs of our users worldwide.

July 2024

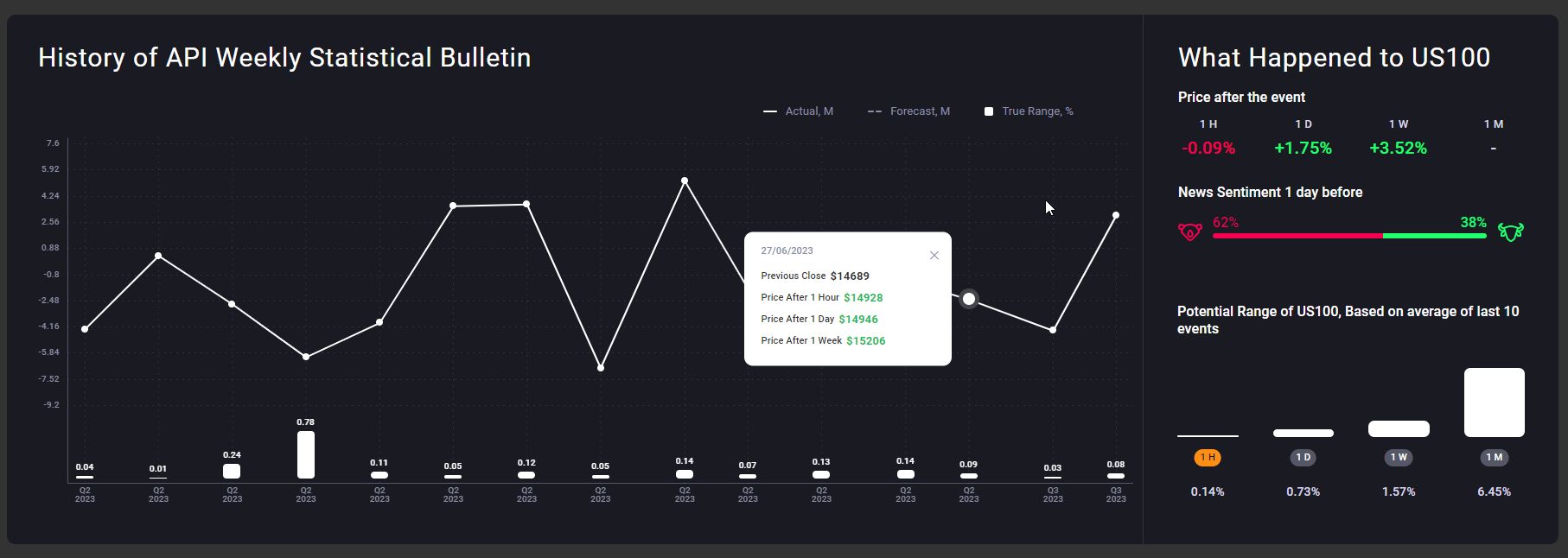

Introducing Enhanced Data Insights in Acuity Calendar’s Event History

We are pleased to announce an update to the Acuity Calendar's Event History feature. Until now, the additional data popup within the Event History only displayed price changes occurring at specified intervals after an event.

With this update, we have expanded the data points to include Previous, Forecast, and Actual event values.

This enhancement is designed to provide a more comprehensive understanding of an event's direct impact on an instrument.

Users can now access detailed event metrics, facilitating deeper analysis and more informed decision-making. By providing a clearer view of how specific events have historically influenced market movements, this update empowers users to conduct more effective and efficient research.

Stay tuned for further updates as we continue to refine our tools to meet the evolving needs of our users.

July 2024

Enhanced Customisation in AssetIQ: Empowering Brokers with further options

We are excited to announce a significant update to AssetIQ, aimed at providing brokers with even more control and flexibility. Understanding the diverse needs of our clients, we have now enabled brokers to personalize their experience by configuring chart granularity, chart type, and default event type directly within AssetIQ charts and any other widgets that incorporate AssetIQ.

This update empowers brokers to tailor our tools to better suit their specific requirements, ensuring that our solutions not only meet but exceed the expectations of our users. By enhancing the customization capabilities of AssetIQ, we reaffirm our commitment to delivering industry-leading, user-centric solutions that adapt seamlessly to the evolving needs of our clients.

Stay tuned for more updates as we continue to innovate and enhance our offerings to better serve you.

June 2024

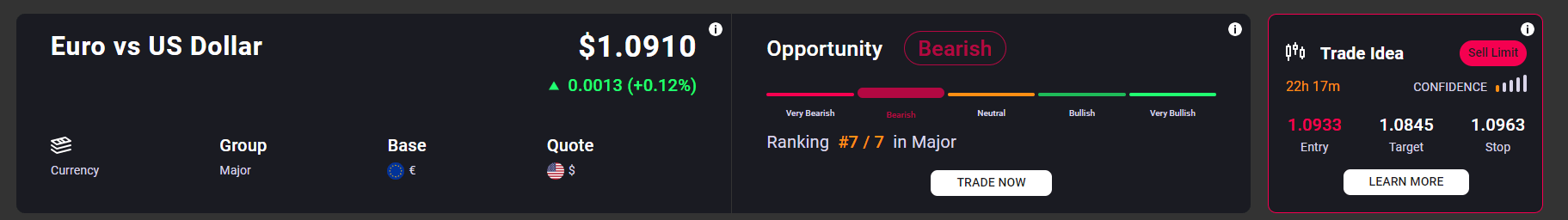

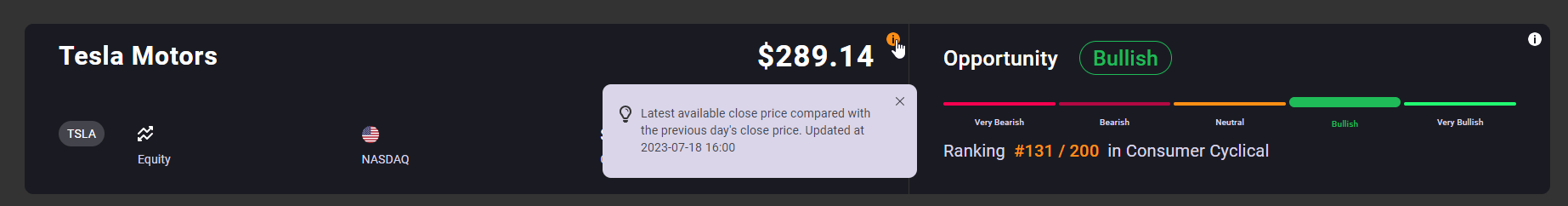

Enhanced Opportunity Ranking in the Research Terminal

We are excited to announce significant enhancements to the Opportunity Ranking feature in our Research Terminal (including the standalone components, such as AssetIQ and Assets Overview). This update improves the display of financial instruments, prioritising those with the highest Opportunity Scores to streamline your research process.

In our latest update, we have integrated a key customisation capability: the inclusion of user-specific watchlists in the ranking process. Now, the Opportunity Ranking feature can filter and display rankings based on the specific financial instruments your brokerage offers. This tailored approach ensures that you are viewing the most relevant and actionable data, aligned perfectly with your trading preferences and brokerage offerings.

These enhancements are designed to empower brokers and traders alike, providing a more personalised and efficient research experience that highlights the most promising opportunities in real-time.

Explore the updated Opportunity Ranking feature today and optimise your research process with unparalleled precision and relevance.

May 2024

Enhanced Push Notification Functionality in MetaTrader: Tailored Trade Ideas at Your Fingertips

We are excited to announce significant enhancements to our MetaTrader push notification capabilities. As part of our ongoing commitment to provide highly personalized and effective trading tools, we have introduced a new feature that allows brokers to curate trade ideas based on specific instrument watchlists.

With this update, brokers can now apply restrictions to the trade ideas being pushed to users, ensuring that only the most relevant and engaging content reaches them. This is in addition to our existing confidence filters, which further refine the accuracy and relevance of the trade recommendations.

Our goal is to streamline the flow of information and make it as impactful as possible, without overwhelming our users with excessive notifications. By enabling brokers to selectively target notifications, we are ensuring that our users receive only the most pertinent trade ideas that align with their investment strategies and preferences.

This update is a step forward in our commitment to enhancing user experience and delivering value through precision-targeted content. We believe that by reducing the noise and focusing on what truly matters to our users, we can help them make more informed trading decisions efficiently and effectively.

Stay tuned for more updates as we continue to refine and expand our services to meet the needs of our dynamic trading community.

May 2024

Enhancements to Dashboard Widget Settings: Simplifying Configuration

We are excited to announce recent enhancements to our Dashboard widget settings creation process that are designed to streamline the setup process for our users, making it more intuitive and efficient.

Introduction of Preconfigured Presets

For customers new to widget customization, we've introduced a simplified starting point. Upon setting up a widget for the first time, users will encounter the "Choose Theme" page. Here, they can select between a new Light theme or the traditional Dark theme. This choice provides a foundational style upon which further customization can be built, or users can dive directly into personalizing their widgets to suit their needs.

Quick Selection of Presets

After initial setup, users can effortlessly switch between Light and Dark themes directly from the widget settings. This feature serves as a convenient baseline for users wishing to create personalized versions of their widgets, adapting the preset themes to their specific requirements.

Favorite Settings Option

We understand that navigating through numerous settings can be time-consuming, especially when specific configurations are frequently used for customization or demonstration. To address this, we've added a Favorite option. This allows users to mark a preferred widget setting as a 'Favorite,' making it the default setting displayed upon opening the widget. If a new favorite is chosen, it will automatically override the previous selection, ensuring the most relevant configuration is always at the forefront.

Duplicating Widget Settings

Previously, creating slightly varied versions of the same widget setting—such as those with different watchlists but identical color schemes—could be cumbersome, requiring manual recreation. With our new duplication feature, this process is no longer a hassle. Users can now duplicate an existing setting with ease, making only necessary adjustments without the need to start from scratch.

These enhancements to the Dashboard widget settings are part of our ongoing commitment to improve user experience and operational efficiency. By simplifying the configuration process and adding flexible, user-friendly options, we aim to help our clients manage their dashboard more effectively, allowing them to focus on what's most important in their business activities.

For further assistance or to provide feedback on these new features, please feel free to contact our support team. We are here to help and look forward to making your experience with our platform as productive as possible. Thank you for choosing our services, and we hope you enjoy these new enhancements.

May 2024

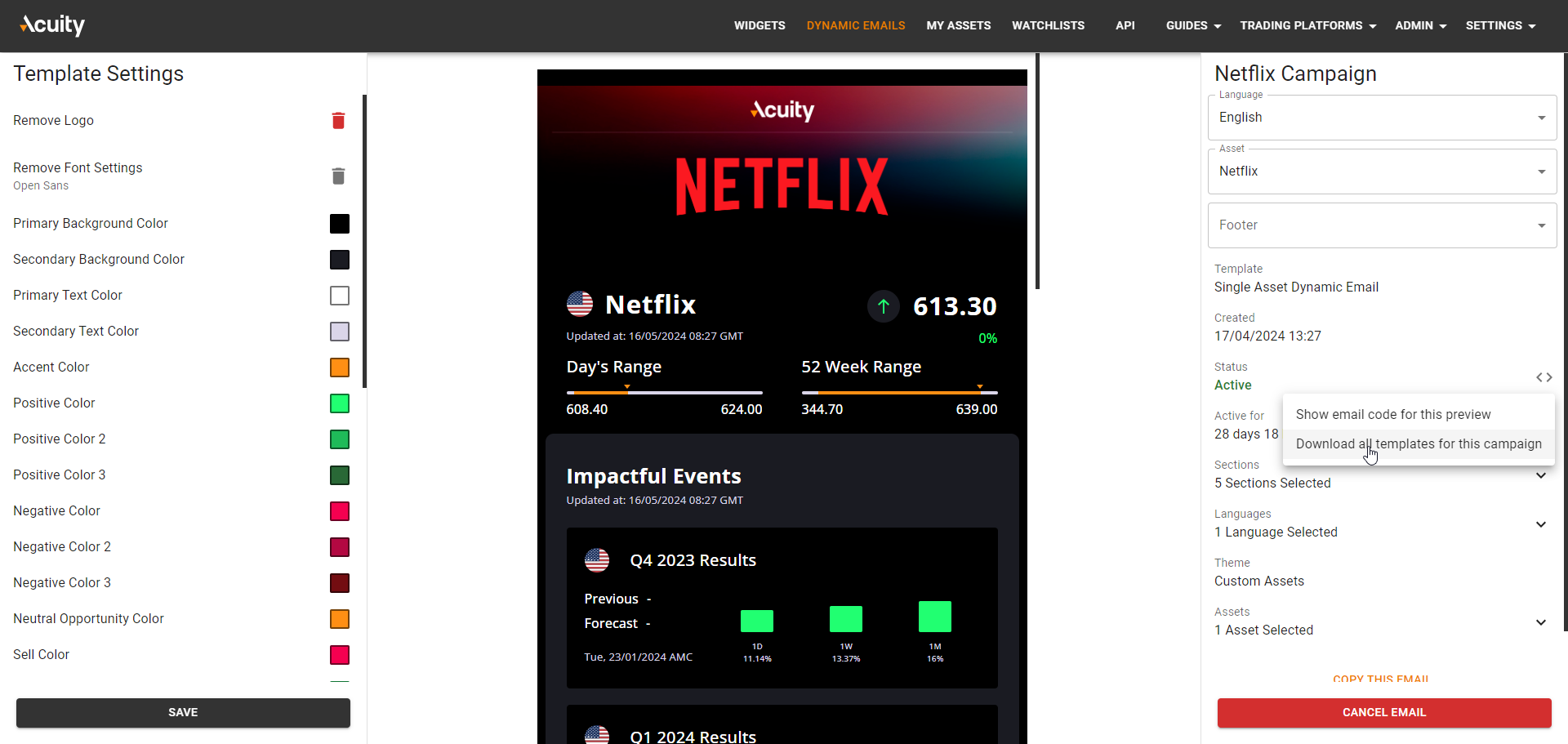

New Feature Update: Bulk Export Now Available in Dynamic Emails Template Editor

We're pleased to announce a recent enhancement to our Dynamic Emails template editor that significantly improves the efficiency of managing email campaigns. Understanding the complexities involved when dealing with multiple assets across various languages, we've introduced a new feature that allows users to export all asset-language-footer combinations into a single ZIP file.

Simplifying the Template Management Process

In the past, our clients who handle extensive sets of dynamic email templates found the process of exporting HTML files to be quite labor-intensive. Specifically, it required selecting each asset and language pair manually within the email editor, a step that could be quite time-consuming.

With the new bulk export option, we aim to streamline this process. Now, brokers and other users with a wide array of dynamic email templates can easily export everything they need in one go, directly using the template editor. This not only saves time but also reduces the potential for errors that can occur during manual selection.

How This Feature Works

The process for utilizing this new feature is straightforward:

- Open the Dynamic Emails template editor. Note: the template or the campaign need to be in the Active state (submitted and approved).

- Select the template you wish to export.

- Next to the Status field you'll see a "Show Code" icon, clicking which you will be able to select an option to download all templates.

- Download the ZIP file, which is now ready to be integrated into your CRM system as needed.

This method ensures that you can quickly access all your necessary HTML files without the hassle of individually exporting each component.

The Impact of Bulk Export

This update is part of our ongoing efforts to enhance user experience and operational efficiency within our platform. By allowing a bulk export of templates, we help our clients save valuable time and effort, enabling them to focus more on crafting effective marketing strategies and less on administrative tasks.

We believe this feature will be particularly beneficial for those managing large-scale email campaigns, where efficiency in communications asset management is crucial.

Get Started

We encourage all users to try out this new feature and see the difference it can make in managing email campaign workflows. As always, we welcome your feedback and are here to support you in getting the most out of this new functionality.

May 2024

Introducing Customizable Decimal Precision in Our Financial Instruments

We are pleased to announce a long-awaited enhancement to our suite of financial tools with the addition of a customizable Decimals field for all covered instruments. This new feature is designed to empower brokers with greater control over how instrument prices are displayed, ensuring precision that aligns with their specific requirements.

Key Enhancements Include:

1. Customizable Decimal Places

Brokers now have the flexibility to configure the number of decimal places for the displayed price of each instrument across all tools and platforms. This customization capability allows for consistency in price formatting, which is crucial for maintaining clarity and precision in financial data presentation.

2. Seamless Integration and Consistency

The customizable Decimals field facilitates a frictionless integration of our tools into brokers’ platforms. With this update, the data presented through our tools will uniformly match the brokers' own systems. This consistency ensures that all users see the same data representation, enhancing user experience and trust in the platform's accuracy.

3. Enhanced Trading Functionality

For brokers utilizing trade functionality within our widgets, this update offers a seamless alignment with their existing systems. The precise match in instrument data formatting between our tools and the brokers’ platforms ensures that trade executions are smooth and error-free, leveraging our enhanced data alignment capabilities.

This update reflects our ongoing commitment to providing adaptable and precise tools that meet the evolving needs of brokers and their clients. By allowing for detailed customization and ensuring data consistency, we aim to enhance the operational efficiency and user satisfaction of financial platforms.

Stay tuned for more updates as we continue to innovate and refine our offerings to better serve the financial community.

May 2024

Enhanced Trading Interactivity with Event Support in AnalysisIQ and Research Terminal

We are excited to announce a pivotal update to our AnalysisIQ and Research Terminal tools that significantly enhances user interactivity and integration flexibility. With the latest enhancement, these widgets now support JavaScript events, emitted during user interactions with the "Trade Now" call to action. This new feature empowers brokers to seamlessly trigger order ticket functionalities directly from the web widget, enhancing the trading experience.

Key Features of the Update:

1. Event Handling

The integration of JavaScript event handling allows brokers to listen actively for user interactions on the "Trade Now" button. Each interaction emits an event, which can be captured to initiate trading activities directly within the widget. This real-time responsiveness facilitates a more dynamic and engaging user experience.

2. Seamless Integration Across Platforms

This update bridges the gap between traditional trading platforms and web-based applications. Whether your users operate on established platforms like MetaTrader or prefer the accessibility of web widgets, they can now execute trades with equal ease. The new functionality ensures that our widgets are more adaptable and can fit into any trading environment, providing users with a consistent and reliable trading interface.

3. Enhanced Broker Control and Customization

Brokers now have increased control over how trading functionalities are implemented within their platforms. This customization extends the utility of the AnalysisIQ and ResearchTerminal widgets, making them more versatile and tailored to specific brokerage needs.

This enhancement is part of our commitment to continuously improve and expand the capabilities of our tools. By enabling more direct and versatile integrations, we aim to empower brokers and traders with the tools they need for a streamlined trading experience.

May 2024

Exciting Enhancements to Dynamic Emails: Configurable Multi-Footer Functionality

We are thrilled to announce a significant update to our Dynamic Emails product that introduces enhanced flexibility and customization options to better serve your diverse communication needs. With our latest release, brokers can now configure multiple email footers within a single campaign, tailored to suit various languages and legal requirements.

Here’s a closer look at what’s new:

1. Multilingual Support

Recognizing the global reach of your campaigns, Dynamic Emails now supports multiple languages for each footer. You can seamlessly integrate as many languages as needed, aligning the footer language with that of the template. This ensures that your communications are not only compliant but also culturally resonant, enhancing engagement across different regions.

2. Multiple Disclaimers for Diverse Jurisdictions

To accommodate the complexities of operating across various jurisdictions, you can now incorporate multiple disclaimers into a single email template. Whether you’re addressing legal nuances or regional norms, our flexible system allows you to tailor content without multiplying your workload. This feature simplifies the creation of compliant, effective email campaigns that respect local requirements.

3. Optional Disclaimer Integration

Flexibility remains a core principle of our Dynamic Emails solution. The new update offers you the option to attach disclaimers to templates as needed. This means that using disclaimers is not mandatory for every template, providing you with the freedom to choose based on your specific needs. If your marketing automation software already includes dynamic disclaimer functionality, you can continue to leverage those capabilities seamlessly with our system.

This update is part of our ongoing commitment to providing you with powerful, user-friendly tools that support your marketing efforts while ensuring compliance and relevance across all your email campaigns. We believe these enhancements will make your email communication processes more efficient and adaptable to the changing business landscape.

April 2024

Introducing Time-Based Free Trials for the Research Terminal in MetaTrader

We are excited to announce a significant enhancement to the Research Terminal, our premier Expert Advisor for MetaTrader users. In our ongoing commitment to provide value and flexibility to brokers and users alike, the Research Terminal now includes a time-based free trial feature.

This new functionality allows brokers the opportunity to offer new users a taste of what the Research Terminal can do, with the freedom to configure the duration of the free trial to best suit their business needs. This feature is designed to streamline the user acquisition process, enabling brokers to attract and engage potential customers more effectively.

During the free trial period, users will enjoy full access to the Research Terminal's capabilities under terms that can be customized by the broker. This could include setting a specific trial period or defining actions that users must complete to unlock continuous access.

Furthermore, we understand the importance of transparency in user experience. To that end, the Research Terminal ensures that all users are well-informed about the trial's progress and what steps are required to transition to full access. This clarity enhances user satisfaction and helps foster trust between brokers and traders.

We believe this update will make the Research Terminal even more essential for brokers looking to provide their clients with superior trading tools and support. Experience the difference today and see how the Research Terminal can transform your user engagement strategy.

April 2024

Expanding Our Reach: Hindi Language Support Now Available in Signal Centre and AnalysisIQ

We are delighted to announce a significant update to our Signal Centre and AnalysisIQ tools: the addition of Hindi language support. This enhancement is part of our commitment to broadening our reach and strengthening our presence in key markets, particularly in India and across Asia.

Signal Centre and AnalysisIQ are renowned for offering robust, easy-to-follow trade ideas crafted by expert technical analysts. By incorporating Hindi, we now cater to a broader audience, enabling millions of Hindi-speaking traders in India and around the world to access our advanced trading insights in their native language.

Key Highlights of the Update:

- Inclusive Access: Hindi language support opens up our tools to one of the fastest-growing markets in the world, ensuring that more traders can utilize our insights without language barriers.

- Localized Content: Providing content in Hindi enhances the user experience, making our tools more accessible and user-friendly for a significant segment of the trading community.

- Strengthened Presence in Asia: This update is a strategic step towards deepening our connections with Asian markets and demonstrates our commitment to adapting our services to meet the diverse needs of international traders.

April 2024

Introducing Assets Overview: Now available as a MetaTrader EA and a cTrader Plugin

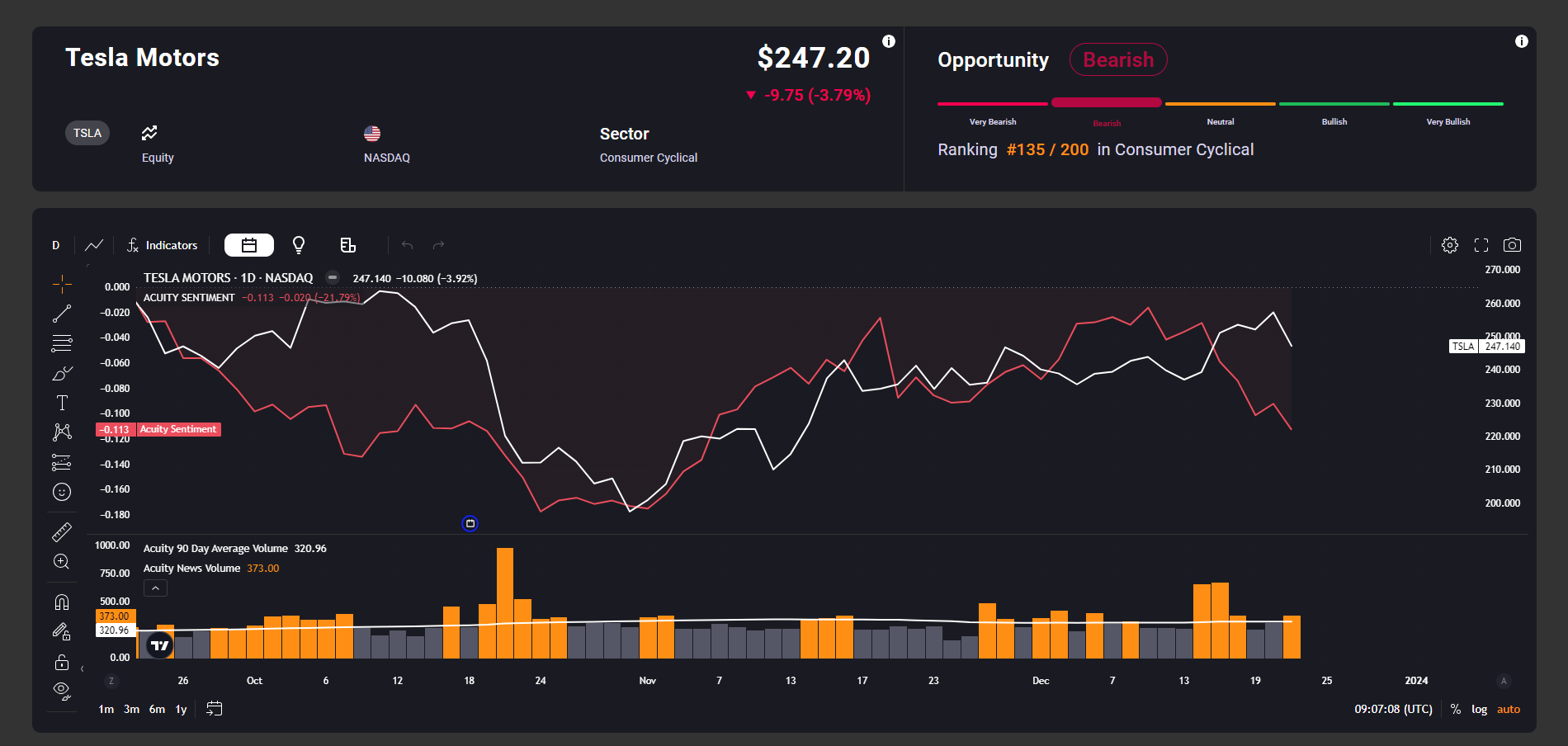

We are excited to announce the release of our latest product update, the Assets Overview tool, now available as a MetaTrader Expert Advisor and a cTrader Plugin. This significant enhancement is designed to empower traders with advanced analytical capabilities directly through their brokerage platforms.

Assets Overview in Action:

The Assets Overview tool integrates cutting-edge analytics with real-time trading environments, providing traders with a comprehensive analysis of market dynamics. By merging news sentiment with price trends, this tool offers a nuanced understanding of how these elements influence the price movements of various trading instruments.

Key features of the Assets Overview tool include:

- Enhanced Analytical Data: Gain access to enriched data that improves decision-making processes, helping you to navigate the complexities of the market with ease.

- News Sentiment Analysis: Understand the impact of market news on trading instruments. This feature allows traders to quickly grasp the interplay between news sentiment and price trends, facilitating more informed trading decisions.

- Integrated News Articles and Calendar Events: Stay updated with the latest market news and upcoming economic events. This integration ensures that traders have all the relevant information at their fingertips, providing additional insights that can influence trading strategies.

- Opportunity Identification: Utilize advanced filters to identify the best and worst performers across various categories. This feature allows traders to spot potential opportunities by highlighting instruments that exhibit significant movements.

Our goal with the Assets Overview tool is to provide traders with a robust platform that not only simplifies data analysis but also enhances their trading strategies through actionable insights. Whether you are a seasoned trader or just starting out, this tool is designed to help you achieve a deeper understanding of market trends and optimize your trading outcomes.

We invite all traders who have access to our tools through their brokers to explore the benefits of the Assets Overview tool and leverage its features for a superior trading experience. Elevate your trading to the next level with our comprehensive, data-driven tool designed to give you a competitive edge in the markets.

November 2023

AssetIQ is now available as a MetaTrader Expert Advisor and cTrader Plugin

AssetIQ Standalone widget is now available as a MetaTrader Expert Advisor and cTrader Plugin.

Brokers that sign up for the undelying data (such as News Sentiment, News, and Calendar Events) are automatically entitled to use this tool in their trading platforms, and it can be enabled on demand.

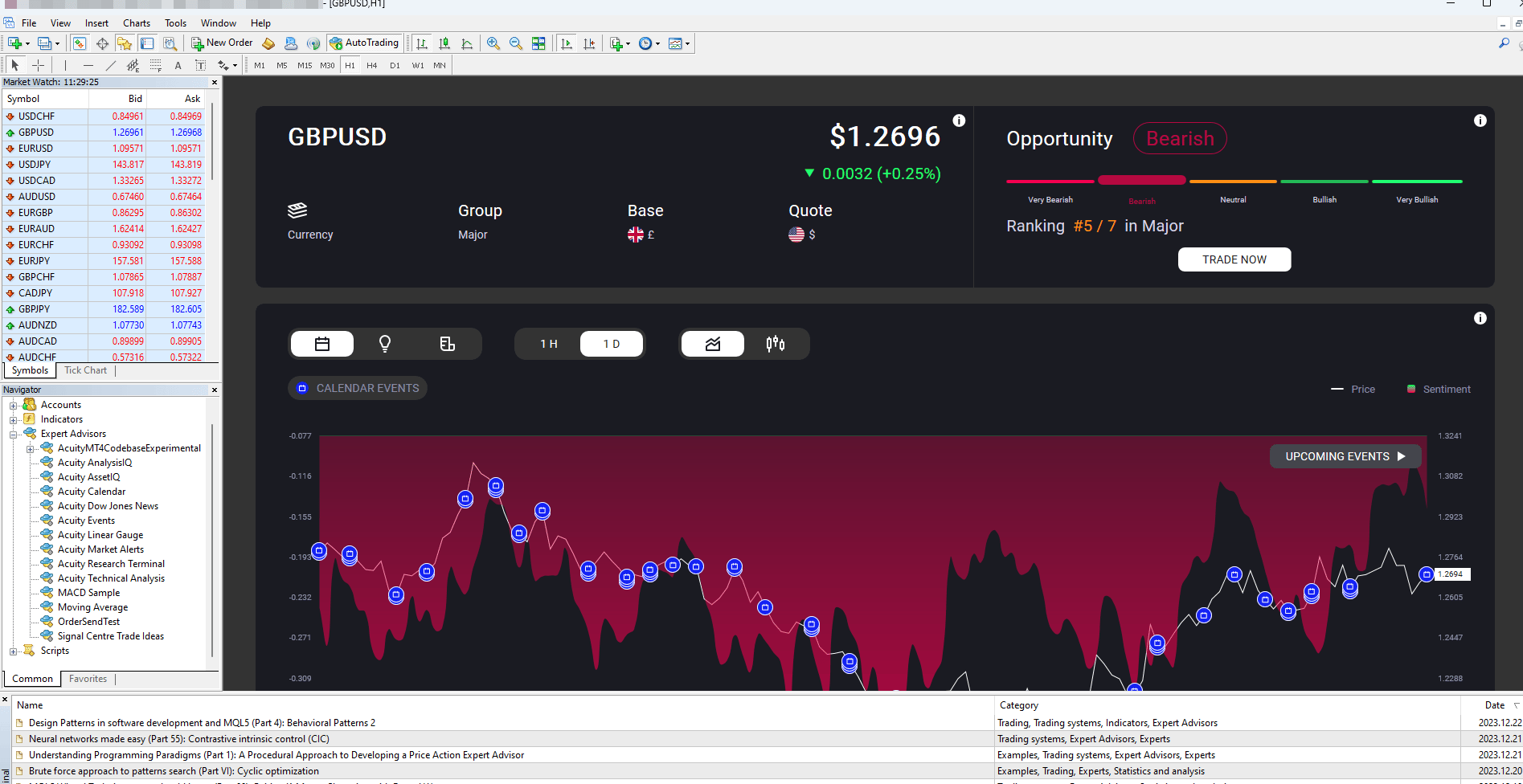

Here is how it looks in MetaTrader:

November 2023

Added a Timeline-only version of the Corporate and Economic Calendars

Many brokers use our tools for acquisition and this use case can be catered for by showing a preview of the content with the goal of getting the traders to perform a particular action to get access to the full content.

We have now added an option for our Economic and Corporate Calendars to be displayed in the Timeline-only view, hiding all the other details, such as Event History, News Sentiment, Potential Price Ranges, News and other data from the initial view. Once traders perform the necessary action (such as a sign up or an account upgrade), they can be directed to the page with the full versions of the Calendars.

This can be easily configured via the Acuity Dashboard:

October 2023

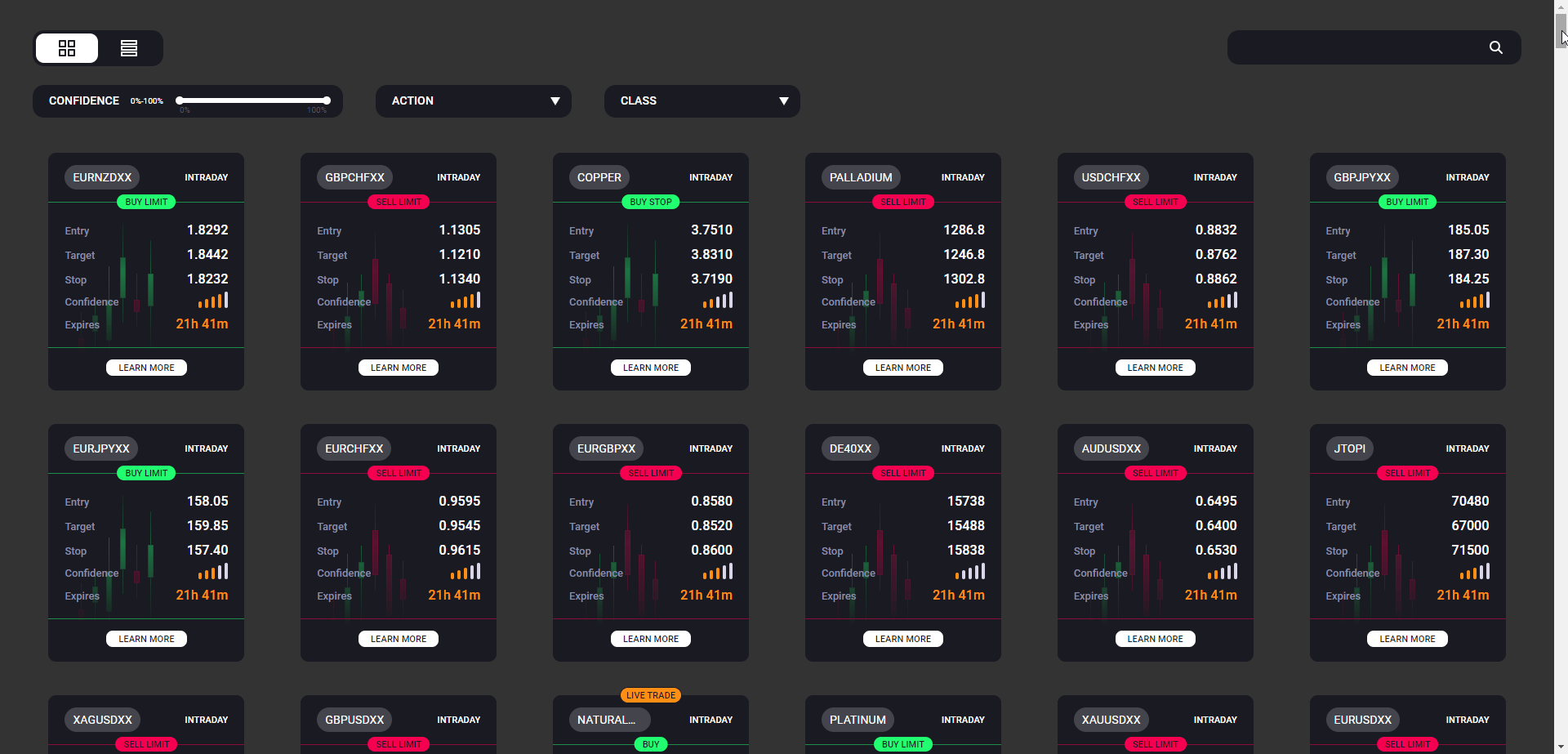

Support for TradingView Charts in AnalysisIQ and AssetIQ

After receiving many requests from brokers we work with to support TradingView charts in our tools, we have enabled the option to use the TradingView's Advanced Charting Package in all of our charts.

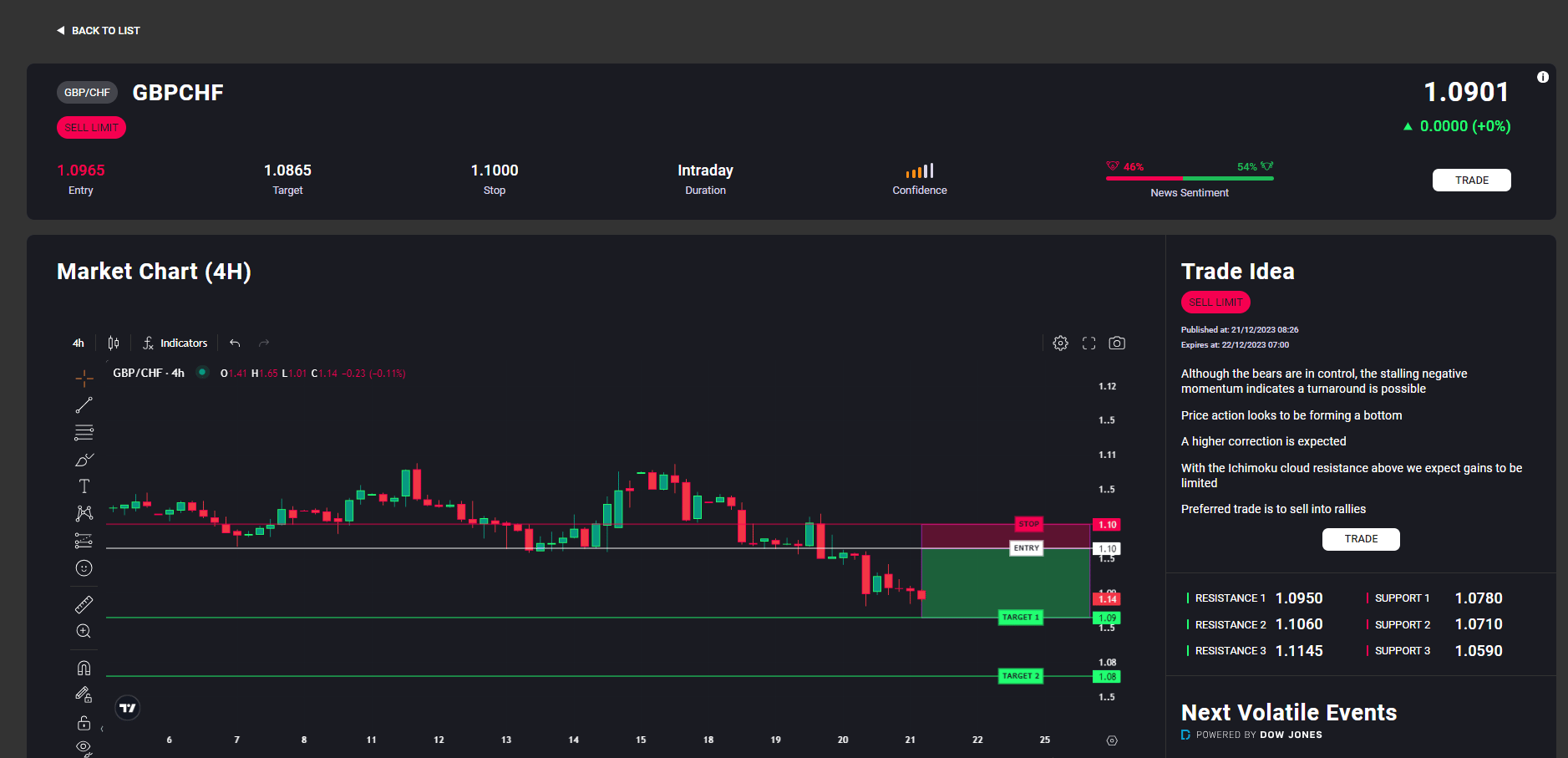

The first tools that received an update are AnalysisIQ and AssetIQ, and this is how the integration currently looks.

AnalysisIQ:

AssetIQ:

October 2023

Signal Stream Freemium Assets

What is it?

This is a feature that we have received many requests for. It has the following goals:

- Allow clients (brokers) to fine tune who gets access to the full functionality of the Signal Stream EA. It could be restricted to Live users, for example.

- Increase conversion rates (from demo accounts to live) by offering clients to sign up for Live accounts or fund accounts, by redirecting them to the relevant URLs from Premium ideas.

- Simplify demo or restricted access to prospects or clients.

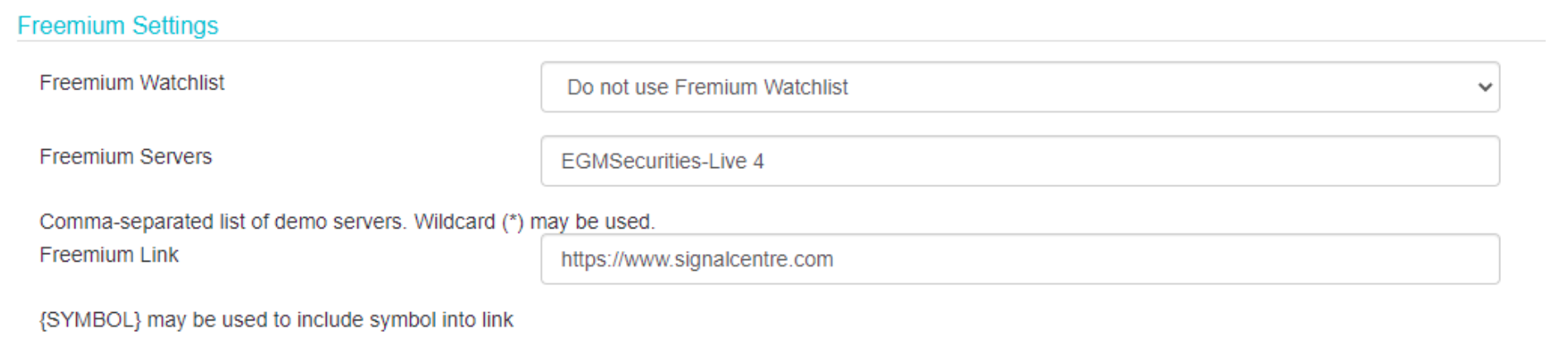

Currently the feature depends on the servers where the brokers would like it displayed. For example, a broker might decide that only the demo server users should see the restricted instrument list. In this case we need to retrieve the list of servers the brokers want to use this feature on before enabling it.

Configuration via the Admin section of the Dashboard

Admin Perspective

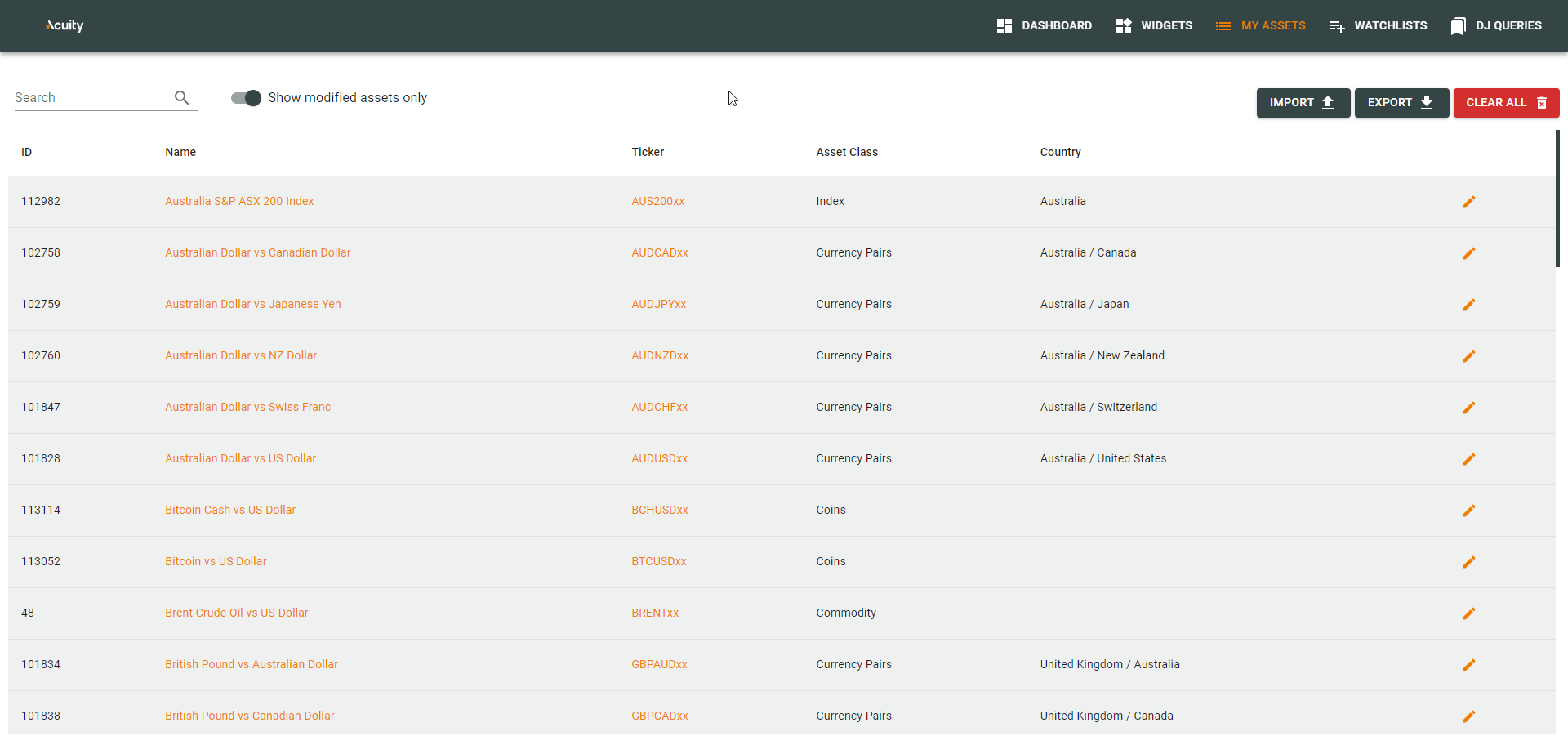

1. Watchlist Configuration

The first step is to create the watchlist that is going to contain restricted instruments:

- Login to https://dashboard.acuitytrading.com with an admin account.

- Go to Watchlists > Manage Widget Watchlists

- Select either Create “Create New Watchlist” or modify an existing one, depending on the need.

- You can also access the Manage Widget Watchlists section using this link.

Note: Freemium Watchlist only needs to be created once. You don’t need to recreate it for each user, although this is certainly possible.

Note: The instruments you add to the watchlist are the ones that we want to hide for the freemium users.

2. Watchlist Filling

Once the watchlist is created, use the following logic to populate it:

- Using the search functionality in the instruments list in the main area of the page, find the necessary assets,

- Once the asset is found, click the + symbol on the right side of the row

- Find the Watchlist you’ve just created or are modifying and click it to add the found asset.

- Repeat for all assets that you need to add.

After completing this step it’s necessary to enable the watchlist on the user’s account.

3. Enabling the Watchlist

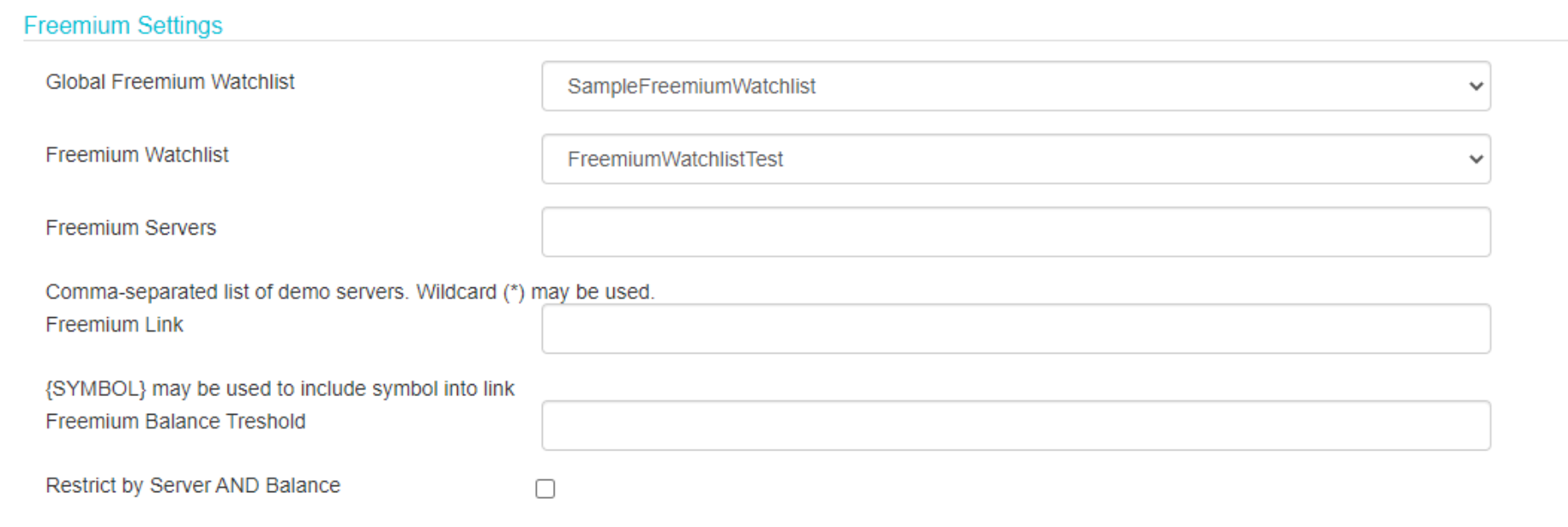

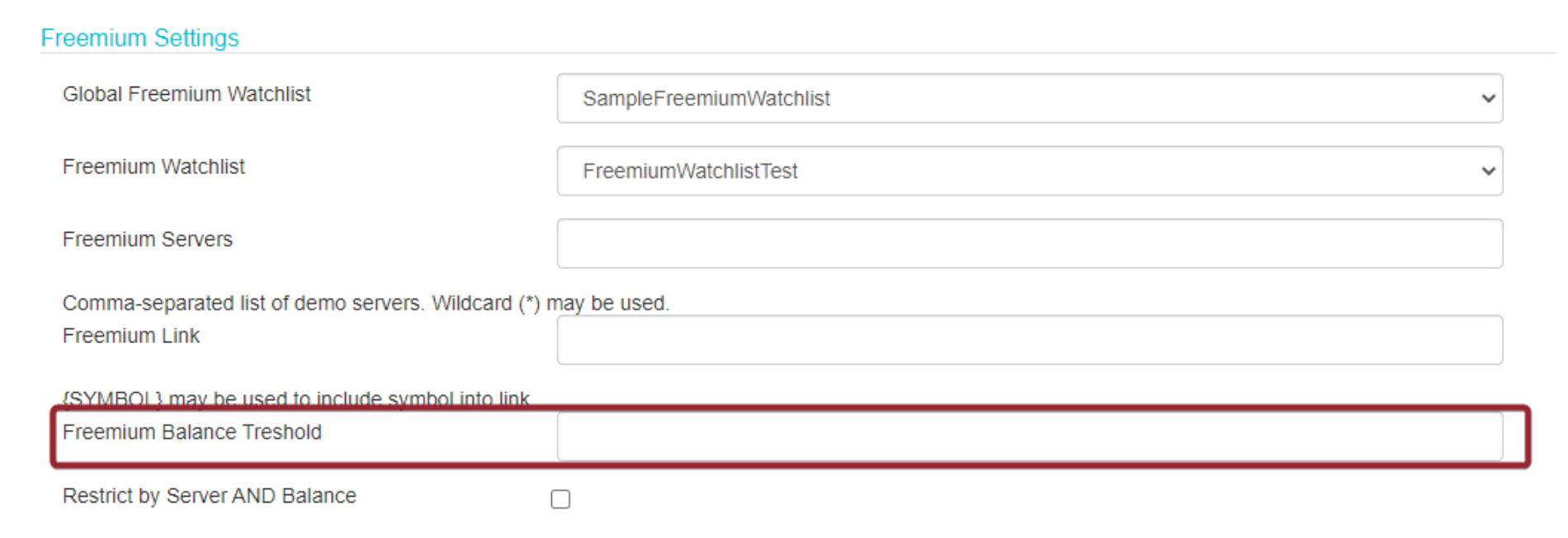

To enable the watchlist on an account, you need to follow this procedure:

- Go to Admin > Users and find the user ID in question

- Go to Keys tab (the same tab where Analytics, EA prefix is configured and where one can retrieve MT4/5 download links). You will see the following:

The default option in the “Freemium Watchlist” field is Do not use Freemium Watchlist. This means that the functionality is not going to be working for the broker if this option is selected.

- Select the Watchlist you’ve just created or updated in this dropdown.

- Enter the MetaTrader Servers where the Freemium Watchlist should be enabled. The servers should be entered in a comma-separated format. Please ensure that no whitespace is added into the server names.

- Enter the Freemium Link – the URL the users will be redirected to when clicking the restricted asset in the widget. This could be a sign up URL or a fund account URL. It’s possible to pass a symbol in this URL so that the user would be directed to an instrument-specific page within the broker’s environment.

This is it! After you hit Save, the Freemium functionality will be enabled for all users for this account, provided that they access the EA from the list of enabled servers.

Client (Broker) Perspective

The configuration is performed by Acuity & Signal Centre account administrators, so there are no changes that you need to make on your account via the Acuity Dashboard.

The Freemium Instrument functionality works based on the servers where the users are connecting from. For example, a restricted instrument list will be shown to users that connect from a Demo server (or any other server that you specify).

To enable this functionality on your account, please provide us with the following:

- Server list where the users should see the restricted instruments list. This could be a list of demo servers within your MT4/5 environments, or simply standalone server names in case you’d like to have some demo servers access full instrument lists as well. Note: we need the actual names of the servers as they appear in MT4/5, not their DNS or IP addresses.

- URL where the users will be redirected to when they click on the restricted instrument. Users could be taken to a page dedicated to the creation of a live account or funding an account etc.

The URL could contain some additional parameters that would allow you to track how many users reach the sign up / fund account page from the Signal Stream EA specifically. These need to be URL parameters that you need to configure before providing to Acuity & Signal Centre admins.

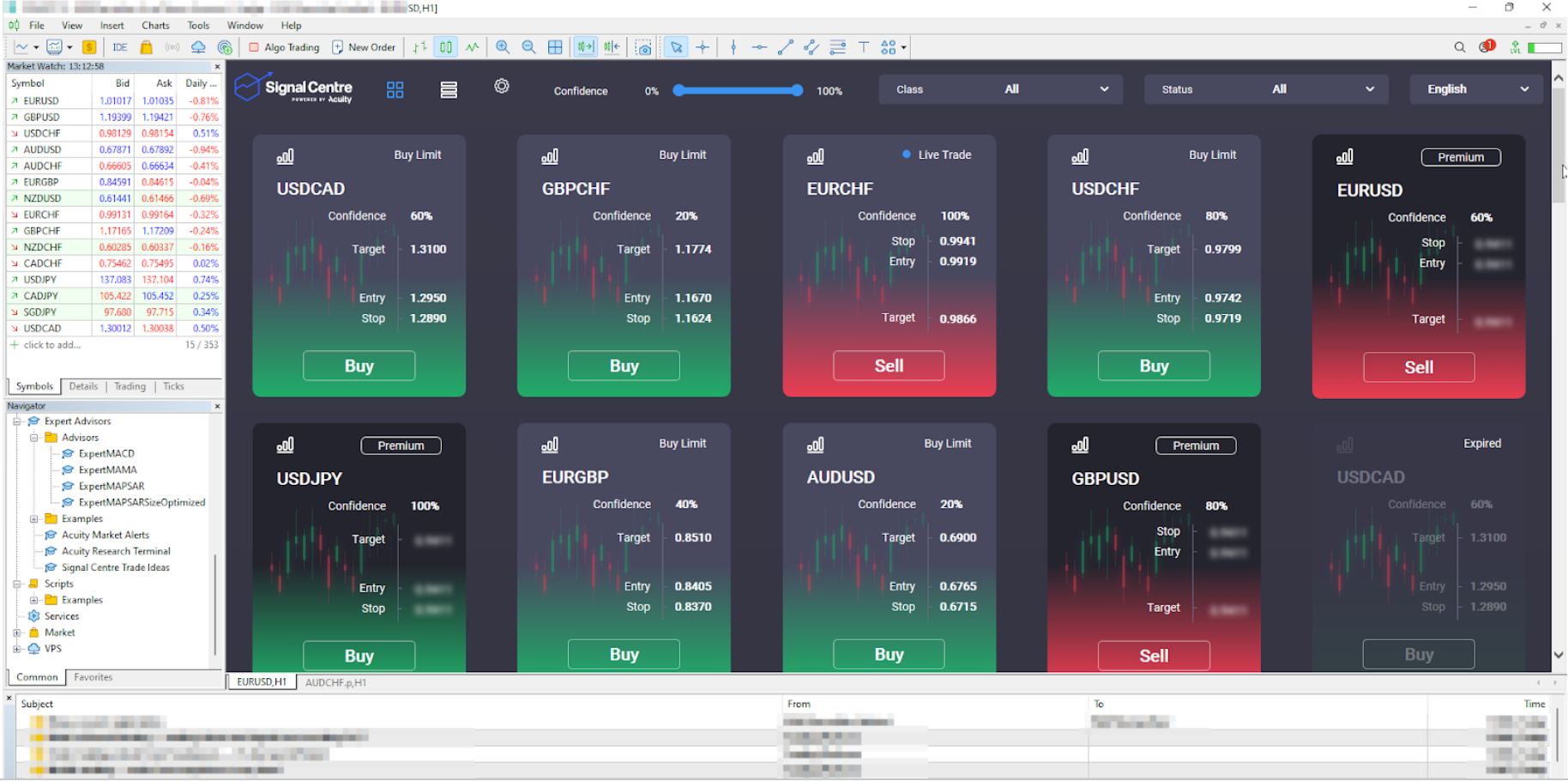

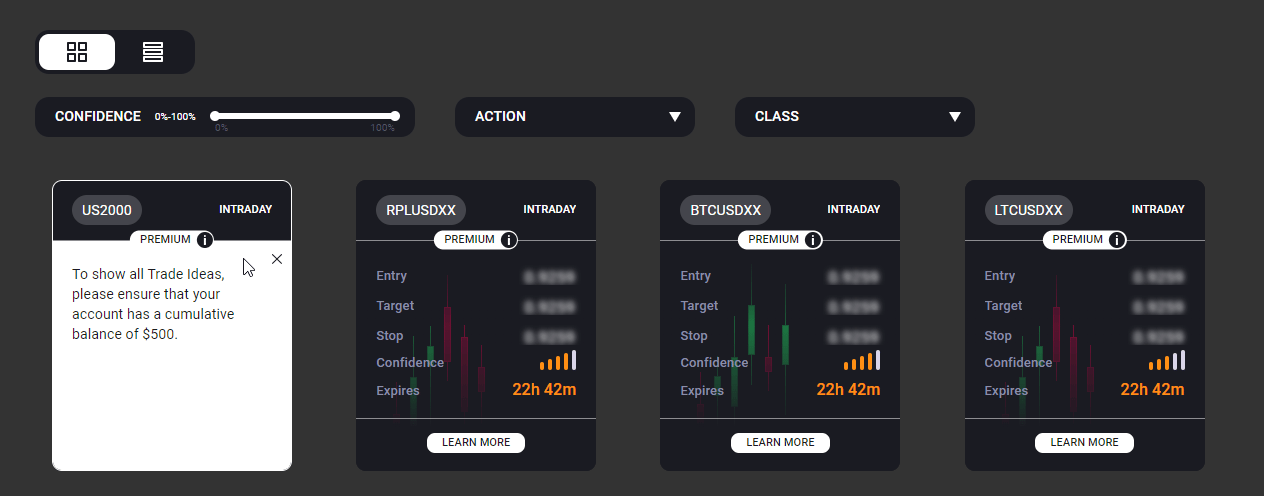

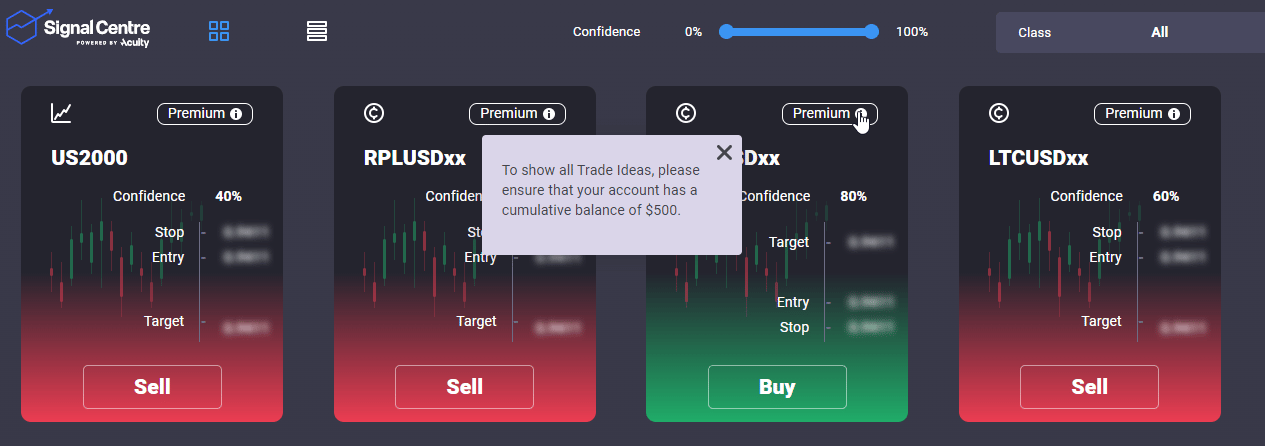

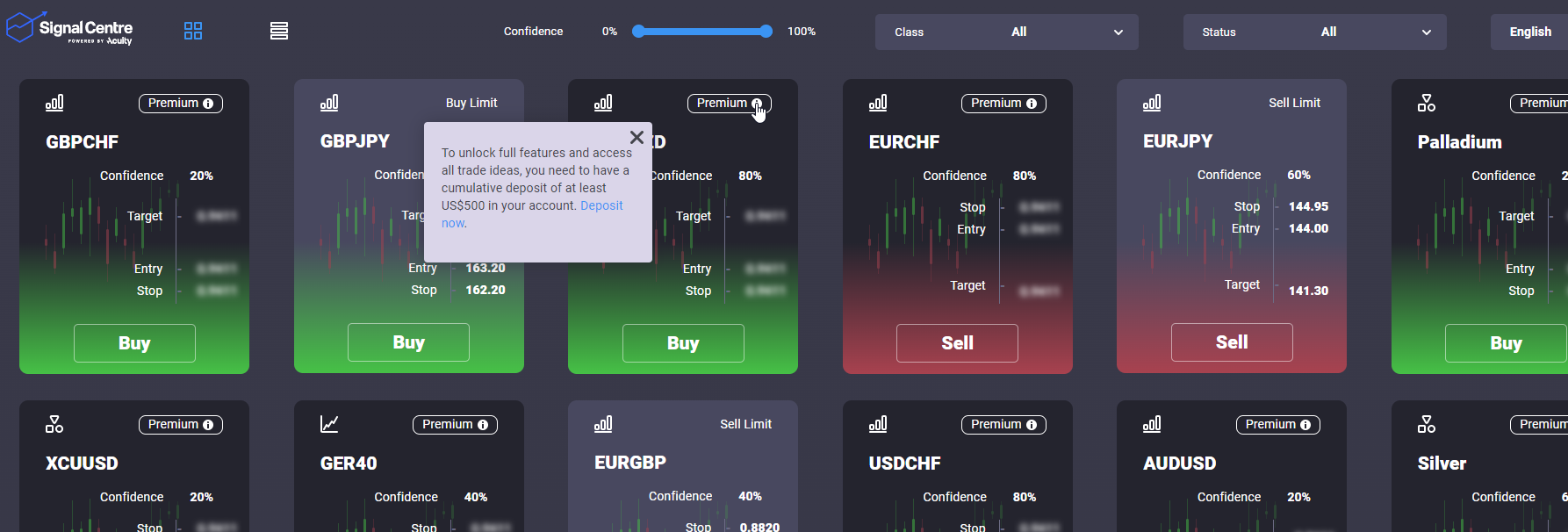

End User Experience

When a user accesses the Signal Stream EA with the Freemium Watchlist functionality enabled, they will see the following:

Instruments that are in the Freemium or restricted watchlist have the following characteristics:

- Different colour, both in Tile and List views

- Labeled as “Premium”

- Key values are blurred out

When the user clicks on one of the instruments from this list, they will be taken to the webpage that the broker provides us, that could lead the user to either open a live account or fund an account, depending on the URL itself.

Freemium Watchlist Improvements

Freemium Functionality on the Web

As of December 2022 we support enabling the Freemium functionality in Signal Stream on the web as well.

It’s configured in a similar way to MT. The only difference is the fact that a different Watchlist type is used: Global Freemium Watchlist. It can be created in exactly the same way as the MT Freemium Watchlist (see the Admin perspective in this document above) and configured via the Global Freemium Watchlist field.

Freemium Functionality by Account Balance

As of early February 2023, we support enabling the Freemium functionality by the MetaTrader account balance.

Brokers can restrict access to certain trade ideas if the balance on the account is below a threshold set here. The balance is in the deposit currency.

Configuration Options

Restrict by Server AND Balance – enabling this checkbox will result in the Freemium Watchlist to be applied only on the specified servers if the balance is below the threshold.

If this checkbox is unset, we will be showing the Freemium Watchlist either on the specified server, or if the balance is insufficient.

September 2023

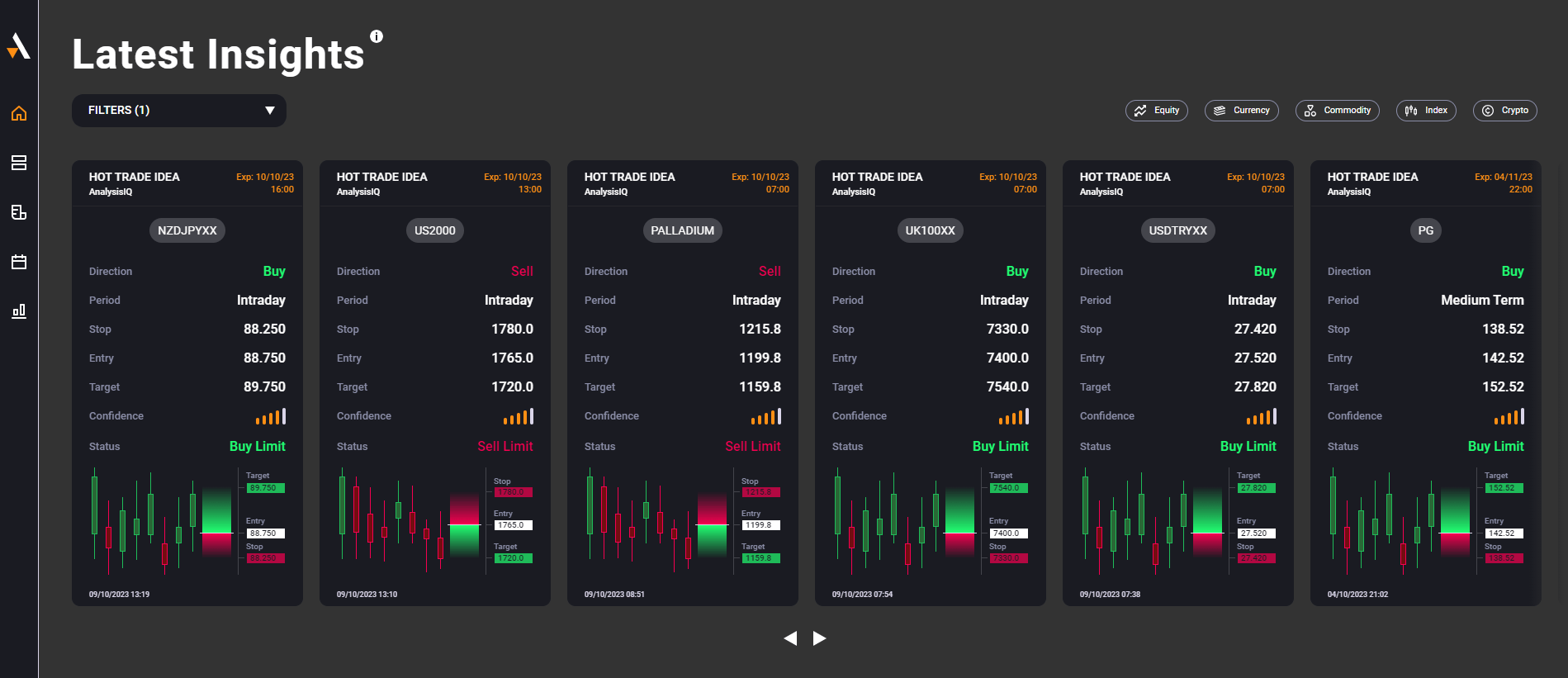

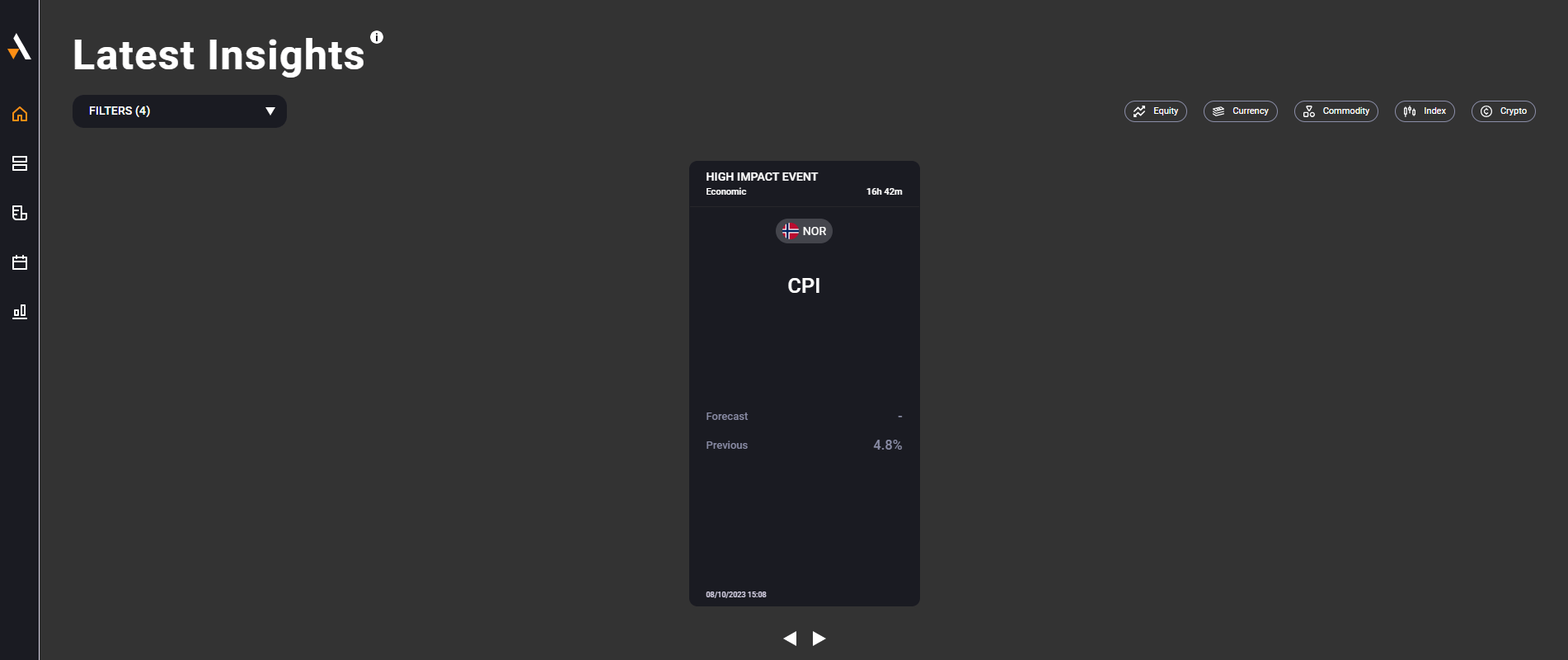

Improved the Insights data in the Research Terminal - Home Page

We've received some user feedback about expanding coverage for the AnalysisIQ Trade Ideas and the High Impact Economic Events in the Latest Insights section of the Research Terminal.

In particular, we include Trade Ideas with over 80% confidence (vs. minimum 85% confidence earlier), and the High Impact Economic Events are included 24 hours before the event (vs. just 3 hours) to allow for plenty of time to prepare for the event.

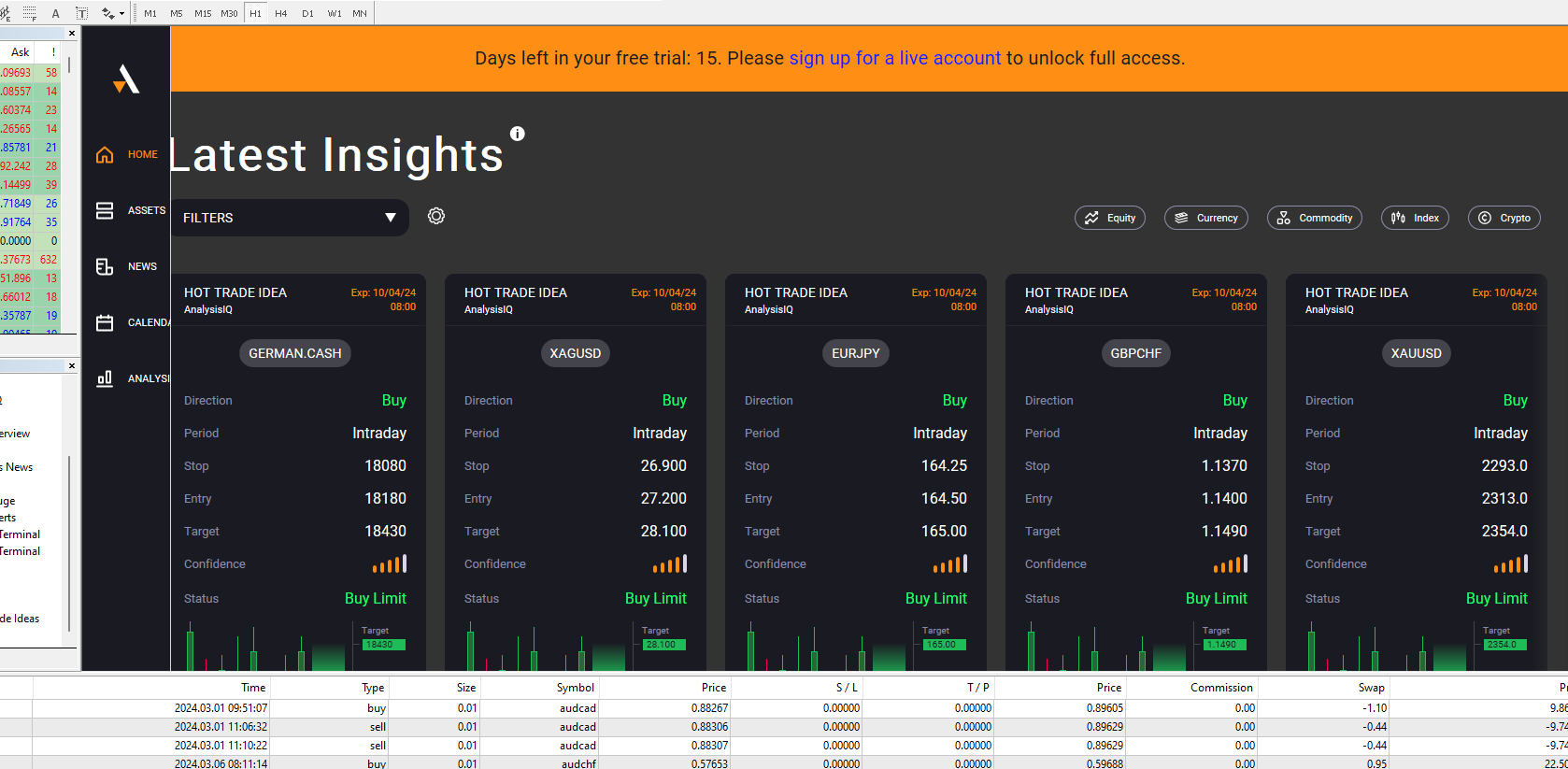

AnalysisIQ:

High Impact Economic Events:

September 2023

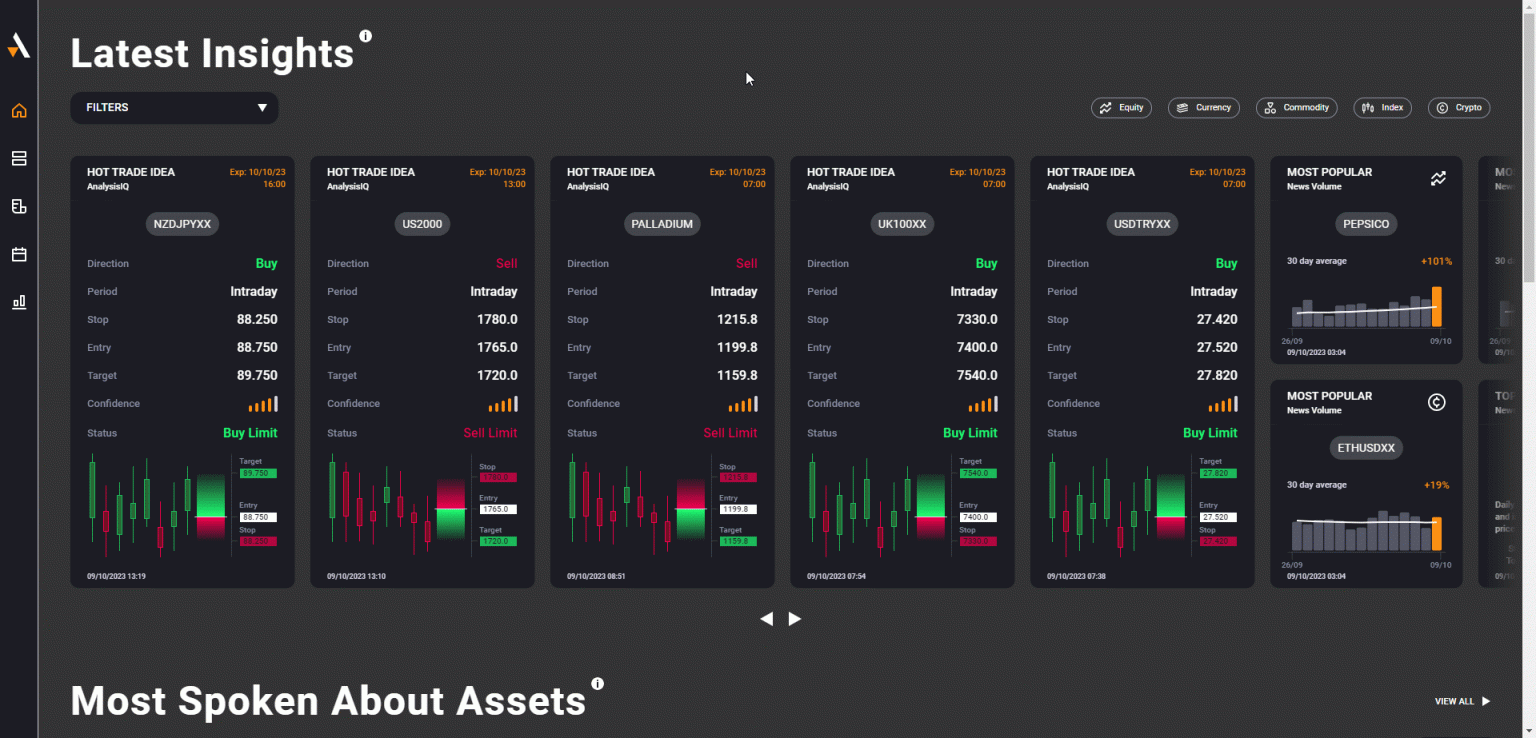

Simplified the process of navigating the Latest Insights section in the Research Terminal

We've received some feedback from our users that the Latest Insights section can be tricky to navigate when many datasets are shown there.

To simplify the process of finding relevant insights, we've added options to filter for the Insight type and the asset class.

This update will allow the users to focus only on the data that is relevant to them, but will leave the door open to discovering new opportunities they are not usually focused on.

September 2023

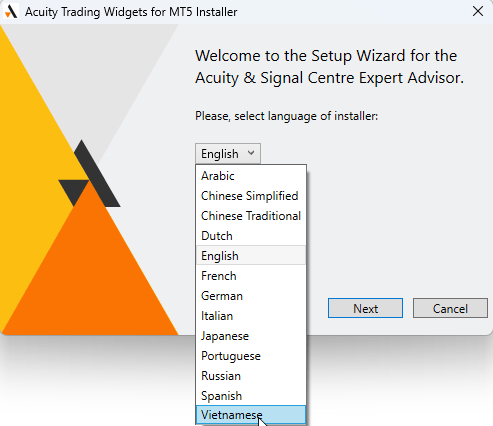

Added Vietnamese as the supported MetaTrader installer language

Many of our users accessing the Signal Stream Expert Advisor in MetaTrader are based in Vietnam, and they requested that we localize the Expert Advisor installer to Vietnamese to make it easier for them to go through the installation process.

We do value our users' feedback, so we went ahead and added Vietnamese as the supported language to the installer:

August 2023

Support for instrument renaming in Signal Stream Telegram Feed

We’ve recently added an option to rename instruments in the Acuity Dashboard to ensure that the correct brokers’ versions of the instrument names are shown in all tools.

We’ve now extended this support to Telegram as well. Any Trade Idea that is sent via Telegram will first check the correct mapping with the brokers instruments and replace the name with the correct version in all relevant places.

This will ensure that users only see information they are used to seeing in all tools on the brokers’ platforms.

August 2023

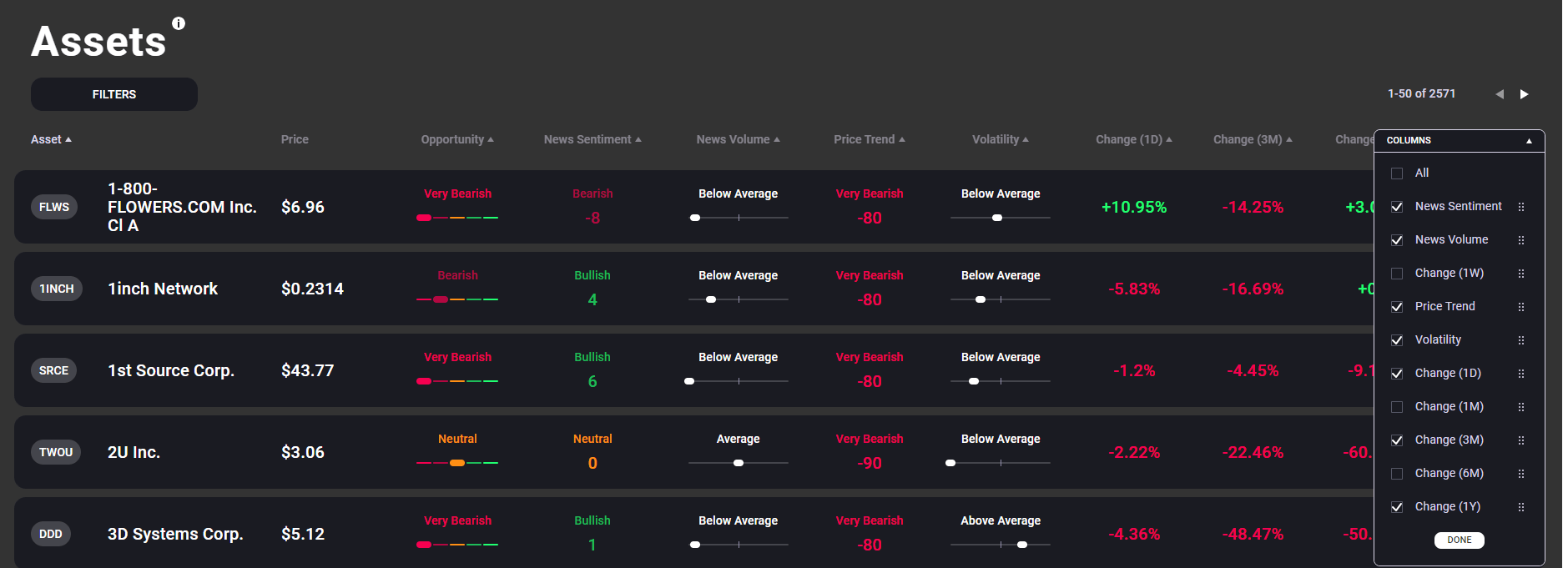

Price performance metrics are now in Assets Overview

We’ve added several price performance metrics into the Assets Overview columns. Users can now select more fields in addition to the ones related to the Opportunity Score.

Users can also reorder the fields using the Column Selection menu. The browser will remember the user’s selection and will show the same columns on the next visit.

These columns also support sorting, which will allow users to more easily focus on top or worst performers when screening for opportunities.

July 2023

Added Analyst Ratings REST and Streaming API endpoints

Acuity Analyst Ratings API service includes the Analyst Consensus data that we retrieve about global stocks and update on a daily basis.

We collect this information programmatically from a large number of news oriented websites, press releases and other resources that publish the analyst ratings principally through news stories (provided by brokers, banks, and other financial organizations).

Having a large number of ratings with these data points allows us to aggregate them. For the ratings that we retrieve, we:

- Check which stocks have received a new rating in a given week

- Retrieve all the ratings for this stock for the past 3 months

- Based on the ratings received, we group them into Sell/Hold/Buy “buckets”, and based on the mean of these ratings provide a consensus (e.g., Moderate Sell if there are a few Sell and a few Hold ratings, a Strong Buy if there are predominantly Buy ratings etc).

It’s possible to retrieve this data on-demand using a REST API, and also to subscribe to updates in real-time via the Streaming API.

June 2023

Added a possibility to rename instruments in the Acuity Dashboard

Very often brokers have their own naming convention for instruments. The instrument names could include suffices or just be named slightly differently from the usual naming convention. If the instrument names are not modified in the tools later, this can cause confusion to the users.

To solve the problem, we’ve added an option for brokers to rename both the symbols and the instrument names in the dashboard to ensure that users see exactly the same information as is offered elsewhere in the brokers’ platforms.

It’s possible to rename individual instruments, as well as upload CSV files and rename instruments in bulk.

Here’s how this looks like in the Acuity Dashboard:

Once the renaming and import is done, it’s possible to perform the following actions:

- Export all original/modified instruments

- Clear all changes

June 2023

Using MetaTrader and cTrader account type as criterion for tool customisation

We have been supporting the Freemium functionality within Signal Stream and AnalysisIQ for some time now. This functionality helps brokers control which content appears for certain groups of their users.

To date we’ve been able to offer the Freemium functionality based on the following account parameters:

- MetaTrader/cTrader Server

- Account Balance

We’ve received some feedback from our brokers that it would also be useful to restrict access by account type, for example, Demo or Live, and we’ve enabled this now.

It’s now possible to create various combinations of the above parameters. For example, it’s possible to show full trade ideas only to Live accounts with over $500 balance.

As a reminder, this is how the Freemium functionality appears within our tools.

AnalysisIQ:

Signal Stream:

June 2023

Implemented the Watchlist functionality in the Calendar tools

Economic events affect a variety of instruments and we note them down in the relevant sections of the Economic and the Corporate Calendars that we offer.

Brokers, however, don’t always offer all of the instruments that we mention in the events.

To avoid a situation where we display instruments in the calendars that brokers don’t offer, we’ve added a Watchlist functionality to the tools. Now it’s possible to limit the Calendar to show only the offered instruments as part of the Affected Assets list, which helps avoid any confusion on the brokers’ sides.

Here’s how this looks in the Economic Calendar:

June 2023

Improvements in linking instruments to events in Acuity Calendars

When Economic Event data is released, it affects various instruments to varying extent. Previously we usually attached affected instruments to the events using the instrument country, for example, if there is US Economic Data released, it would affect US indices, currencies with US Dollar etc.

We have received feedback from our users that they are missing certain instruments when viewing the data for certain High and Medium impact events. In particular, metals and energy commodities were missing from the list of affected instruments.

We’ve taken this feedback on board and reviewed how we identify affected instruments for each event. Metals, energy, and agricultural commodities are now attached to more events that affect their prices and that traders are closely monitoring when viewing the event data.

May 2023

Signal Stream Telegram bot improvements

Here are the new configuration options:

- Live Trades Only – this option will only publish Live Trades to the group or the channel

- Timezone Offset – this option will change all timestamps in the message to the specified offset. This is useful if the audience of the channel is from a particular region.

As for the new data points, each message now includes the Expiry date & time for the trade idea to indicate how much time the users have left to act upon the trade ideas.

May 2023

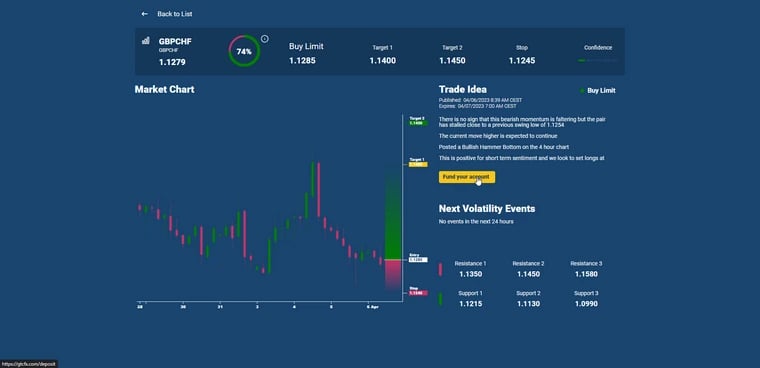

AnalysisIQ – Improve the ordering of trade ideas and modify the full details layout

The original version of AnalysisIQ had trade ideas grouped by asset classes by default. We’ve received some feedback that it can be inconvenient, especially if the user is interested in a particular asset class which is not immediately visible.

To resolve the concerns, we’ve implemented a more natural publication time based ordering in the dashboard. Additionally, we’ve implemented a filter that allows users to display trade ideas related to a single asset class should they wish to do so.

Original layout:

Improved layout:

As part of the same update, we looked at how the information is structured inside the full trade idea view. Previously, a large portion of the tool was occupied by the chart and the important details, such as the trade idea justification, were hidden from the users. We’ve now made sure that the prominent details are immediately visible.

This is how the details appear after the update:

May 2023

Added support for MetaTrader Live Prices for all Expert Advisors using the pricing data

Some of our tools, like AnalysisIQ or Signal Stream, need to have access to live pricing data in order to deliver the most value to the users, as the content heavily relies on it.

Previously, we used our own pricing data in the tools, including their Expert Advisor form. This meant that sometimes the latest price value or the chart wouldn’t match what the users could see in MetaTrader directly.

We’ve now added logic that fetches live pricing data from MetaTrader and displays it in the relevant sections.

May 2023

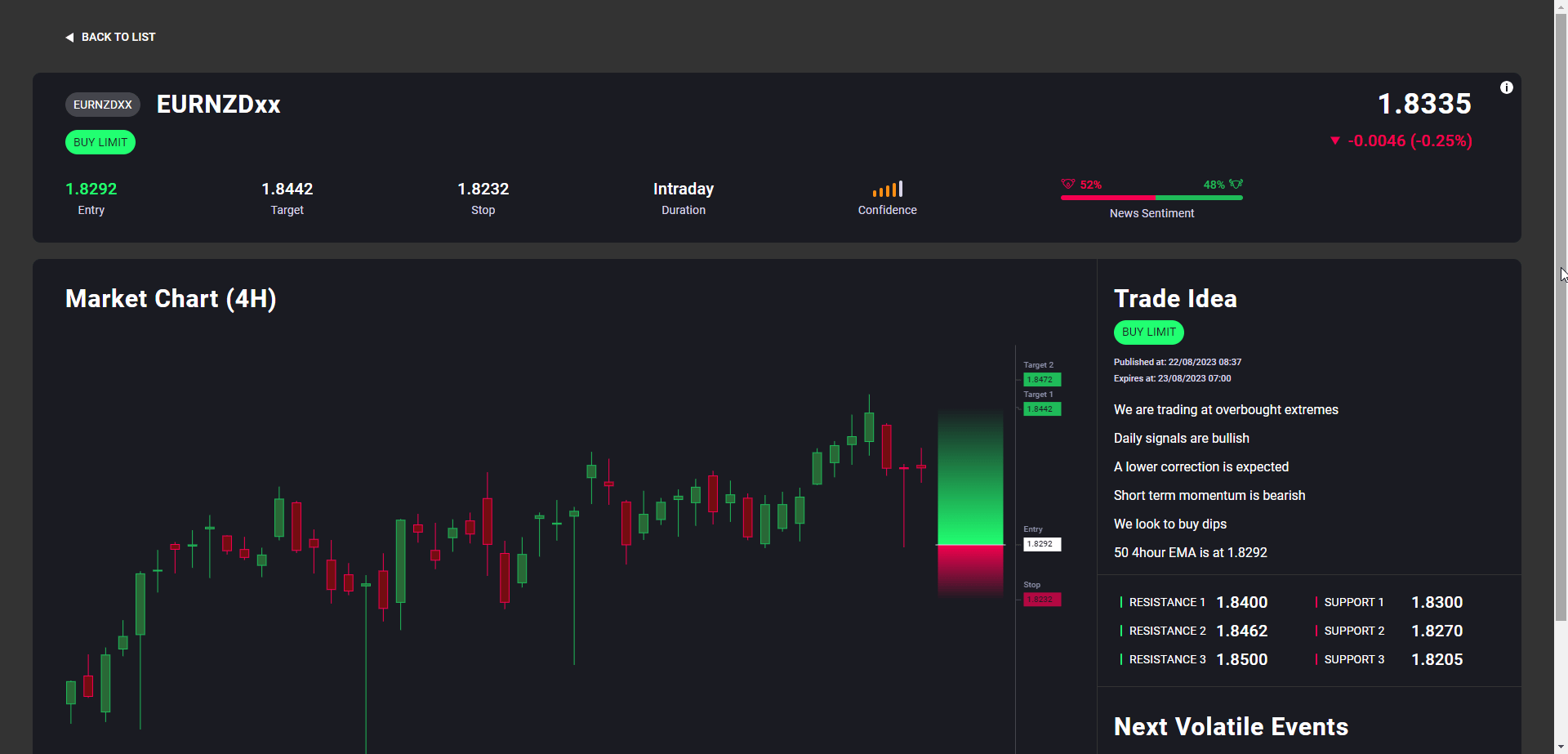

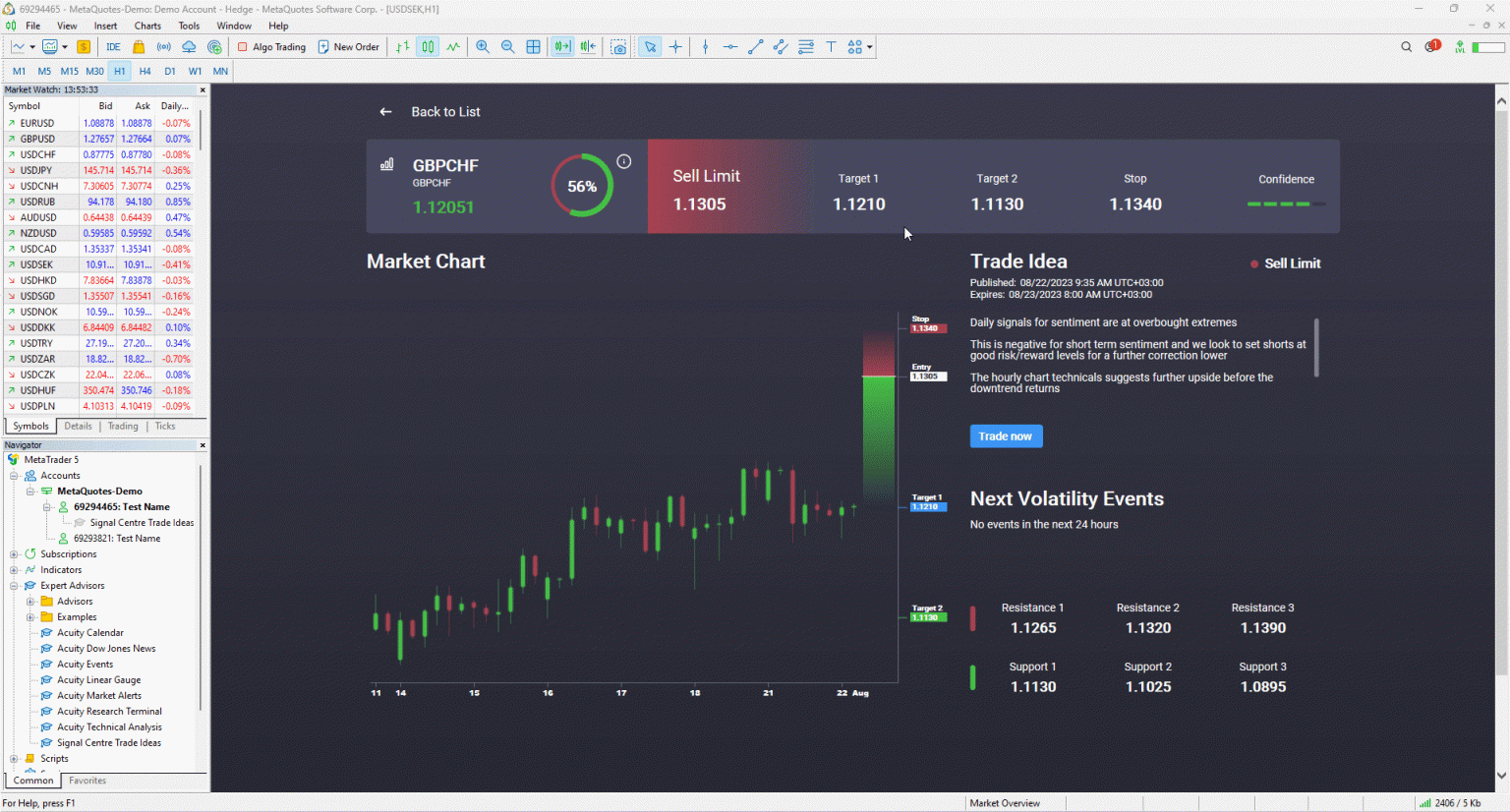

AnalysisIQ as a MetaTrader EA and cTrader Bot

Following a successful launch of AnalysisIQ in its web widget form, we’ve implemented a version suitable for Trading Platforms.

It’s now possible to access AnalysisIQ as an EA (in MT) or a cBot (in cTrader) and be able to execute trades based on the signals provided.

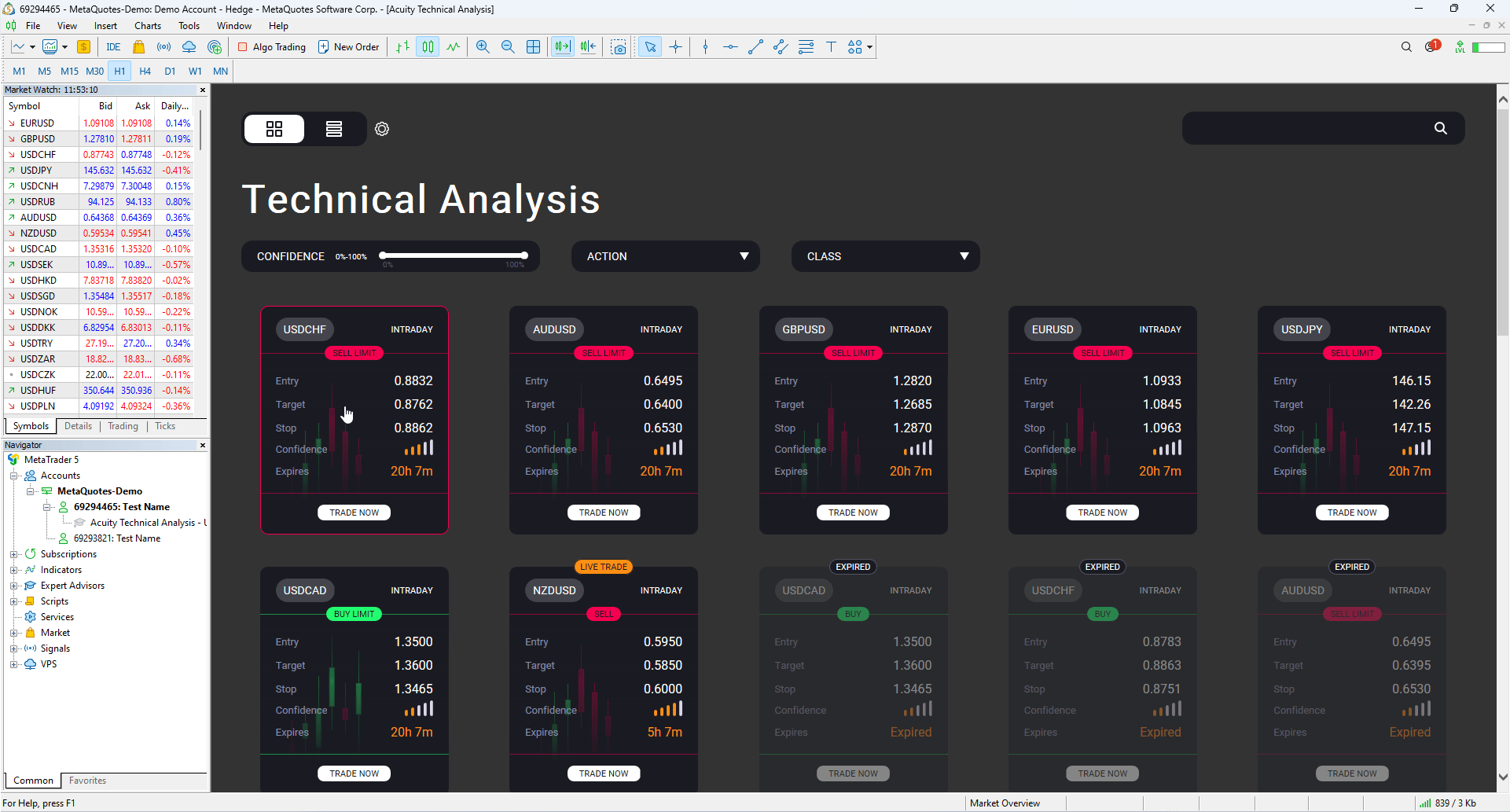

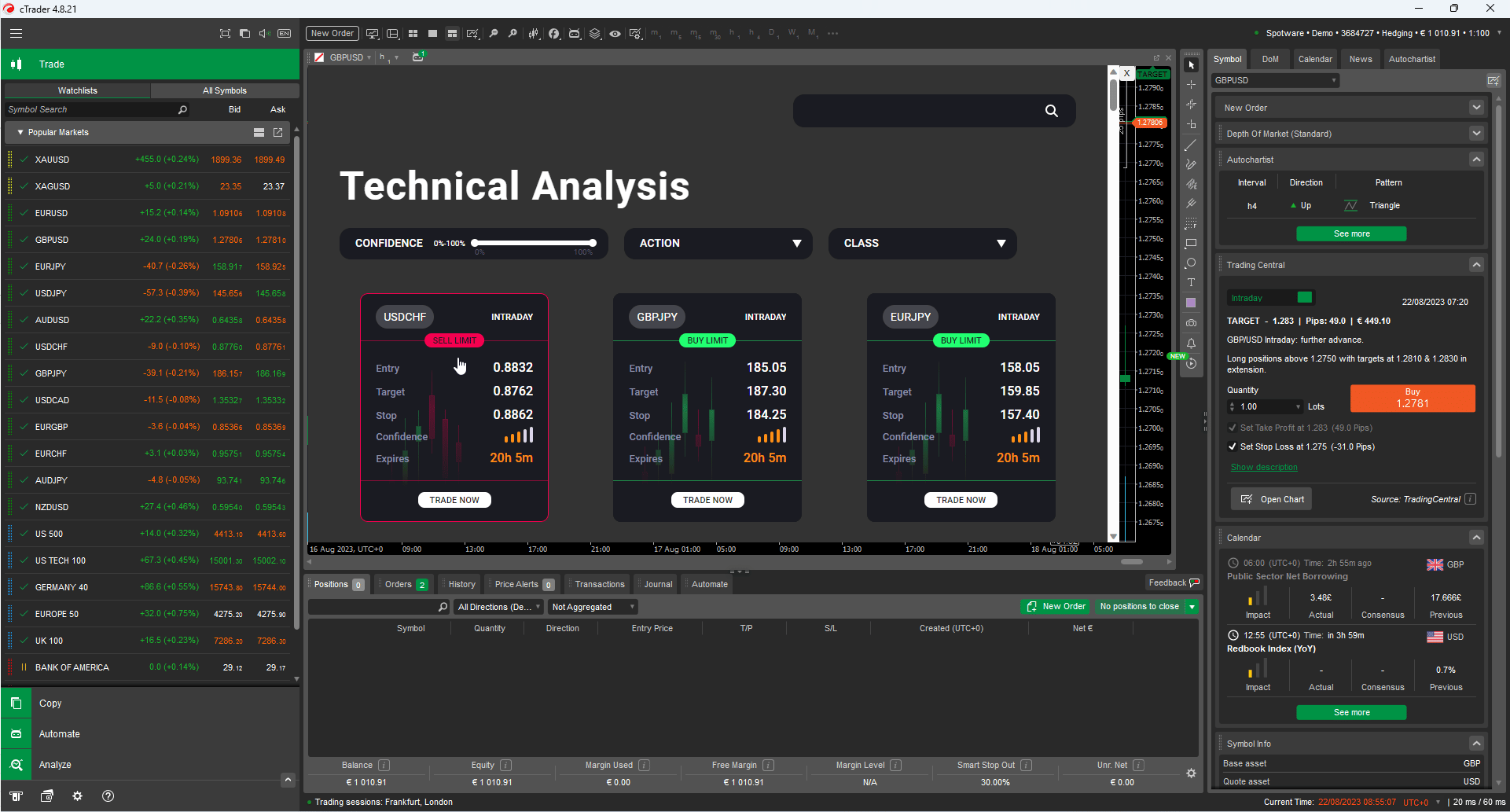

Here’s how the EA appears in MetaTrader:

Here is its cTrader appearance:

April 2023

AnalysisIQ and Signal Stream – additional context for premium data

Analysisiq and signal stream both offer a freemium version that enables brokers to choose which trade ideas are publicly visible and which ideas are only accessible to a specific group of customers (such as live accounts or accounts with a particular balance).

We have received some feedback indicating that the action associated with these Premium data points is not clear to the users – it’s not immediately known that a user needs to sign up for a live account or fund an account.

To resolve this, we added tooltips with customisable text to the Premium data points. The tooltips can be displayed both in the web versions of the tools, and in the Trading Platforms (such as MetaTrader or cTrader). In trading platforms, they can dynamically populate relevant values, such as the required account balance.

Here is how they appear in the tools.

AnalysisIQ:

Signal Stream:

The goal of this feature is to make it easy for brokers to control the content that various user groups see, and clarify to the users what action they need to take to enable the full experience in the tools.

April 2023

Added a link between AssetIQ and AnalysisIQ in the Acuity Research Terminal

The research terminal offers a variety of data elements that assist traders and investors in identifying opportunities. It may be difficult to connect these data points at times to create a clearer picture of what is happening with the instrument because they are sometimes found on different pages.

We combined the analysisiq data with the assetiq data (the opportunity score, which is derived from the price trend, volatility, news sentiment, and news volume scores) in order to make this easier to understand. If there is an active trade idea for the instrument displayed in assetiq, we will display all of the pertinent information on one page:

By doing this, we give traders and investors a more complete view of what’s happening with the target instrument, enabling them to decide more quickly and with greater knowledge.

April 2023

Added improvements to a few tools that indicate the age of displayed information

Based on feedback from some users, who were sometimes reporting not being able to know exactly how old the information displayed in our widgets is, we added a few sections into the tools that provide these details.

Here’s how this looks in the Economic Calendar:

Based on feedback from some users, who were sometimes reporting not being able to know exactly how old the information displayed in our widgets is, we added a few sections into the tools that provide these details.

Here’s how this looks in the Economic Calendar:

The goal of including this information is to make it clearer to the users when a particular data point update occurred to allow them to plan their trades or perform research with a bit more precision.

March 2023

Added several improvements to the Signal Centre and AnalysisIQ tools

- More detailed control over settings: it’s possible to modify Tile Font Colour and Background Font Colour separately, also change the colours of the Buy / Sell Label Text. This helps to customise the tools a lot better.

- Added a Tooltip to the Premium ideas. Now the user can click in the ‘i’ icon and get the information about exactly why an idea is restricted. This can be configured by an Admin in the Dashboard (by Acuity & Signal Centre employees):

- We now support CTAs in the Web version of the Signal Stream widget. We can add a button with some custom text (for example, Fund an account) and redirect the user to a particular URL when they click it.

March 2023

Improved the account configuration options for Account Management and Sales teams

Prior to this change we were showing all EAs in MetaTrader, for which the customers have permissions. Now it’s possible for Sales and Account Management teams to choose which EAs to display, which gives brokers more control over what their users see in the trading platforms, whether they need to prepare any marketing materials for the tools, and allow to do that at their required pace.

August 2022

Implemented and launched the new Economic and Corporate Calendar EAs in MetaTrader

Customers who are given the “Acuity Calendar” and the “Can access MT4”/”Can access MT5” permissions will now received a new EA, called Acuity Events, in MetaTrader. This will allow them to benefit from the new calendars in MetaTrader directly.

August 2022

Implementation of regional failover functionality in our backend

We now support automatically failing over to a different region, in case the SQL database services become unavailable in our main region. This will prevent our customers from having problems with most of our retail-oriented tools if the database goes down. In addition to that we now support our service replicas in Asia, which makes it a lot quicker for our Asian customers to use our tools.

August 2022

Implemented option to modify the style of the original Signal Centre Dashboard

We supported the style modification for the new Technical Analysis widget, but we did not allow colour modification for the original version. The original version is still widely used, and after multiple feedback items received from clients requesting this change, we finally implemented it. It’s now possible to modify the styling fully for the original Signal Centre dashboard.

August 2022

Improvement for discoverability of Calendar Events and News on the Asset IQ Chart

When users added Calendar Events or News onto the chart, it was not clear that the events could be clicked to get more information. We’ve now added a CTA (Find out more) to the events that allows to view the full news item or the event.

August 2022

Addition of customizable CTAs to the Economic and Corporate Calendars

It’s now possible to add a CTA to the Economic and Corporate Calendar with customizable text, so clients can add “Open a Live Account”, “Start Trading” etc links to our tools.

July 2022

Addition of a possibility to add custom CTAs to the Asset IQ page

It’s now possible to add a custom CTA to a few sections in the Asset IQ page. Users can customize the following:

- CTA text (Start Trading Now, Trade Now, Open a Live Account etc)

- CTA Text and Button Colour

- URL that the user is taken to when the CTA is clicked

This should make it easier for brokers to customize this page according to their needs and increase certain metrics, like sign ups, conversions etc.

June 2022