Economic reports and geo-political news developments spur short-term volatility in the global financial markets, altering risk profiles and asset valuations. However, the market volatility that ensues also leads to opportunities for online trading. So, whether you are a long-term or short-term trader, following and trading the news could be an integral component of your investment strategy.

Impact of News Releases on Market Momentum

When breaking news hits the market, it has the power to impact traders’ perception regarding overall risk. This could either have a significant impact on asset price or a muted one, as traders take time to digest the news release, especially when it is against market expectations.

Negative news tends to cause people to sell assets, leading to a downward pressure on the asset price. This could take several days or weeks to play out. For instance, the spread of Covid-19 from January 2020 onwards, subsequent lockdowns imposed around the world, together with the oil price war between Russia and Saudi Arabia, led to the beginning of a stock market crash from March 9 onwards, as investors resorted to panic selling worldwide.

Similarly, positive news reassures investors about long-term economic growth and injects positive or “bullish” market sentiment. This could be due to a good earnings report by a company or positive economic indicators like GDP and interest rates.

Understanding the Relationship between the News and the Asset

Whether the news is positive or negative depends on the data in question. For example, a rise in the Consumer Price Index (CPI), above the target level set by the Central Bank, leads to lower interest rates. This puts a downward pressure on the domestic currency, as lower interest rates reduce its appeal for foreign investors.

On the other hand, an increase in the GDP growth rate leads to appreciation of the domestic currency, as investors gain confidence in the country’s growth trajectory.

Market Consensus vs. Actual Figures

Based on trade reports, forecasts by investment analysts and economists, the market forms a general consensus about upcoming economic data. If the actual release is lower than market expectations, although showing a positive trajectory, it can lead to a decline in asset prices. For instance, in March 2011, the US economy grew 1.8%, instead of an estimated 1.9%. Immediately following the news release, the euro appreciated about 50 pips against the US dollar. Traders decided to sell a weaker dollar, helping the euro cross the 1.4200 resistance level.

News Volume and Overall Risk Sentiment

The more the number of news releases in a day pertaining to an asset class, the greater the scope of market volatility. If we look at the Australian market, there are a number of factors that can lead to market volatility and changes in investor risk sentiment:

- Policy meetings of the Reserve Bank of Australia (RBA)

- US jobs report

- China’s economic data releases, including earnings reports of Chinese companies that import Australian commodities

- US fiscal stimulus measures for the Covid-19 crisis.

These reports and more could lead to volatility in the Australian stock market, the ASX 200 index and currency pairs including the Aussie dollar, such as the AUD/USD and AUD/NZD.

The reality is that high news volumes, associated with a particular asset, the greater the trading interest in that asset is likely to be. In fact, high new volumes can lead to higher market focus on the asset, leading to higher trading volumes. In addition, when there are multiple news sources discussing the same asset, the market sentiment can get coloured by fear or greed, leading to higher volatility.

But how do traders access so many reports, released on a daily basis, and then use them to understand their impact on asset price?

The Acuity News Volume Bar

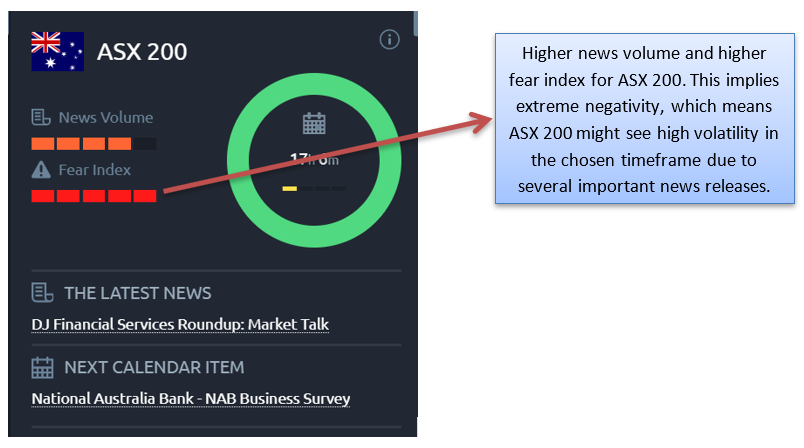

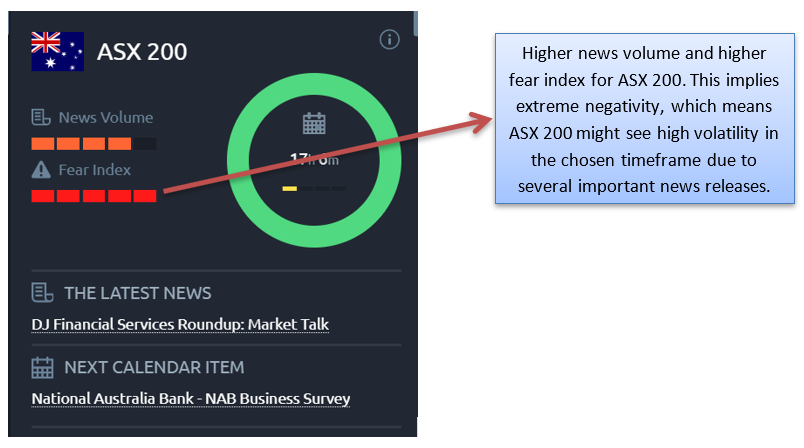

The Acuity Sentiment Analysis tool is designed to ease the process of sourcing all relevant news for a particular asset. If you look at the middle section of the tool, you will see the “News Volume” section for the chosen asset class.

The above image relates to news relevant to the ASX 200 index. The number of bars in this section indicates the volume of news releases that might impact the index. If you scroll down, you will see The Latest News that can drive investor sentiment on this asset, along with the schedule of the next economic release to hit the market.

News volume data can also help with identifying which stocks are being talked about most, even beyond their average daily news flow. This can help us identify trading opportunities beyond just the largest stocks, such as Apple or Facebook. We can then take advantage of even the smallest value change in a stock, riding the news wave.